Press release -

Millennials face a demonstrable insurance gap of R15 trillion

South Africa’s young adults could bridge the growing life and disability insurance gap by diverting a fraction of their monthly lifestyle expenditure to financial services products. According to Gareth Friedlander, Head of Research and Development at Discovery Life, it would take as little as 4,6% of the average millennial’s salary to revolutionise the insurance coverage achieved by the country’s 19 to 30-year olds.

The low uptake of insurance among millennials are rooted in behaviours typical of this population segment and include frequent changes in employment; mistrust of the financial services industry and misperceptions about the cost of insurance products – 53% of millennials indicate that they cannot afford insurance. “This is a mobile generation that changes cities and jobs at the drop of a hat,” said Friedlander. “By age 35 a quarter of millennials will have worked five or more jobs – making it extremely difficult to plan and save for the future.”

Friedlander was presenting the findings of a comprehensive study into insurance among young adults, titled MAROUNs, or ‘millennials at risk of underinsurance’. The MAROUNs study recalculated the insurance gap to reflect the economic realities and behavioural trends relevant to this important social demographic. This generation represents the future of the South African economy in terms of its potential participation in the workforce by 2025.

“By our calculation, the largest insurance gap is currently presented by millennials between the age of 18 and 30 and we expect this situation to worsen unless we can influence outcomes in some way,” said Friedlander. He observed that the gap was calculated based on the insurance an individual in this age group needed to be optimally protected against a death or disability event, versus the actual insurance cover held.

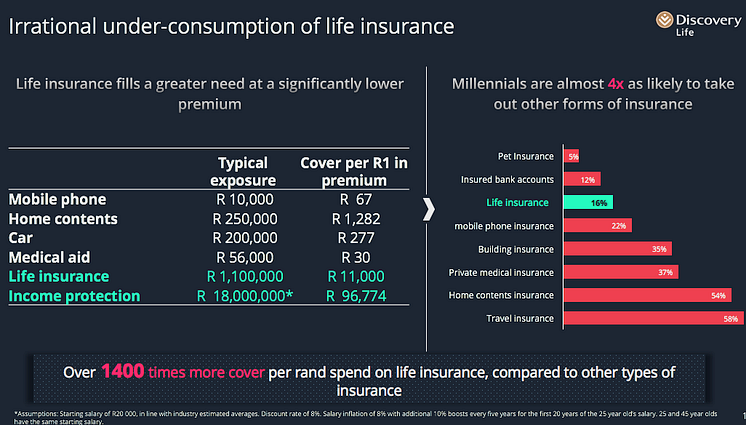

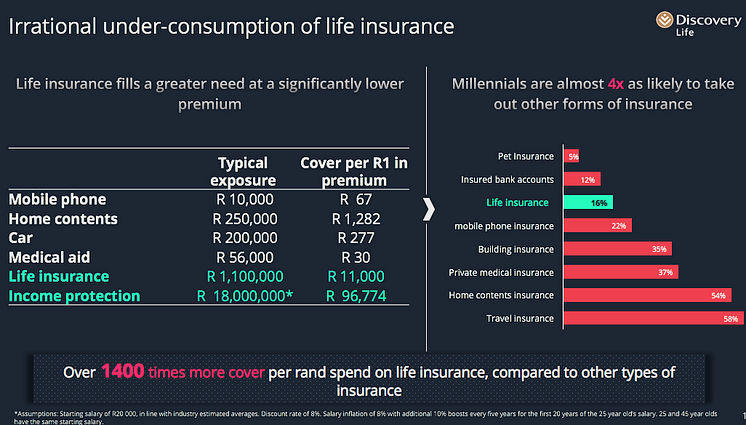

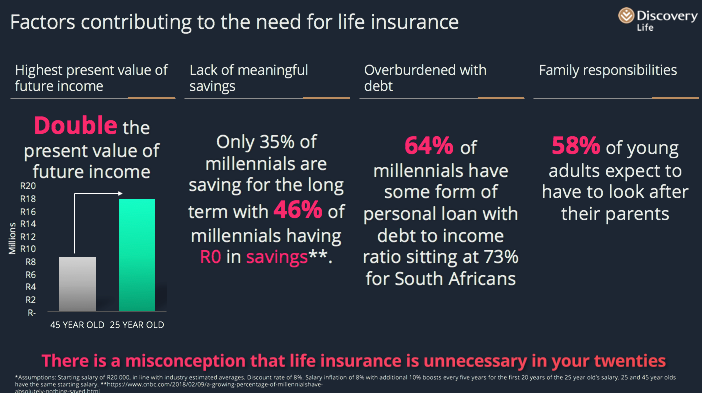

The key outcomes from the study confirm a gap exists that is likely to widen unless stakeholders in the financial services sector find a way to influence millennials’ behaviour. ASISA calculated the insurance gap on death and disability for the 19 to 30 age group at R9 trillion; but Discovery believes it is significantly larger. “We identified various factors that suggest SA’s young adults should be seeking additional life and disability cover as compared to the overall population,” said Friedlander. “Principal among these is the fact that a young person will need more income protection should they suffer a life changing event, especially given that this population segement is expected to live longer. In fact, we found that the present value of future income for millennials is twice as high compared to indviduals between the age of 50 and 54, at approximately R18 million for the averga 25 year old graduate.”

The savings culture among SA’s millennials to date has been disappointing. They have followed the example set by previous generations and worse, with only 35% of this sector saving for the longer term. And a staggering 46% of millennials have no savings at all – they have nothing to serve as a buffer should a financial ‘shock’ occur. Poor levels of saving are made worse by high levels of indebtedness with almost two in three millennials having some form of personal loan outstanding.

Another challenge is the tendency to defer insurance buying decisions until spouses and children enter the picture. Statistics confirm that the median age for marriage has moved up from 31 to 36 years of age; while the age for first-time mothers has tipped into the 30s. “There are a lot of financial needs that are crucial even before you have a partner or children,” said Friedlander. He urged millennials to get over their ‘present’ bias and to think of longer-term investment needs rather than immediate gratification.

Discovery recalculated the insurance gap by taking account of a number of factors. These are; the increasing life expectancies seen in this population segment (now sitting at approximately 80 years for the average Discovery member), the larger share of household income lost on a disability event given that people are getting married later, and the higher salary growth rates experienced by millenials early in their careers as a result of promotions (or moving jobs). These factors result in the shortfalls to balloon from R4.1 to R5.6 trillion in the death insurance market and from R4.9 to R9.4 trillion in the disability space.

The challenge to the financial service sector is to design affordable, customisable and innovative products that ‘match’ millennials needs and wants. Discovery’s Smart Life Plan, launched in March 2018, is a step in this direction. It addresses the issues laid bare by the MAROUNs study and enables financial advisers to provide customised life and disability benefits, tailored to the unique risks that millennials are exposed to.

Topics

Categories

Discovery information

About Discovery Limited

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment products and wellness markets. Founded in 1992, Discovery was guided by a clear core purpose – to make people healthier and to enhance and protect their lives. Underpinning this core purpose is the belief that through innovation, Discovery can be a powerful market disruptor.

The company, with headquarters in Johannesburg, South Africa, has expanded its operations globally and currently serves over 5 million clients across South Africa, the United Kingdom, the United States, China, Singapore and Australia. Discovery recently partnered with Generali, a leading insurer in Europe, and has partnered with John Hancock in the US. These new partnerships will bring Discovery’s shared-value business model to protection industries in Europe and the US.

Vitality, Discovery’s wellness programme, is the world’s largest scientific, incentive-based wellness solution for individuals and corporates. The global Vitality membership base now exceeds three million lives in five markets.

Discovery is an authorised financial services provider and trades under the code “DSY” on the Johannesburg Securities Exchange.

Follow us on Twitter @Discovery_SA