Image -

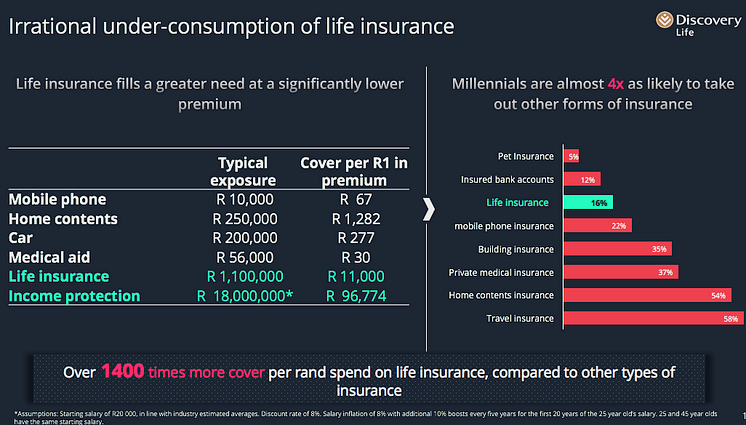

Millennials Insurance Gap - Factors contributing to the need for life insurance

Discovery Life

- License:

- Media Use

The content may be downloaded by journalists, bloggers, columnists, creators of public opinion, etc. It can be used and shared in different media channels to convey, narrate, and comment on your press releases, posts, or information, provided that the content is unmodified. The author or creator shall be attributed to the extent and in the manner required by good practice (this means, for example, that photographers should be attributed).

- By:

- Discovery Life

- File format:

- .png

- Size:

- 1026 x 584, 151 KB