Hylton Kallner is appointed as CEO of Discovery Bank

The bank is poised for growth with the behavioural model revealing the lowest-risk client base in the industry in under two years since launching to the public

The bank is poised for growth with the behavioural model revealing the lowest-risk client base in the industry in under two years since launching to the public

The Discovery Prepaid Health platform brings affordability, transparency and predictability to the costs of care by allowing users to buy prepaid vouchers for valued services – starting with face-to-face visits to a GP with access to medicine, all-inclusive at R300.

Discovery Vitality today announced the release of its Care Gap Report which highlights the extent to which members engaged in health behaviours and accessed health promotion and preventative services during COVID-19 lockdown.

Discovery Bank today announced new and even more convenient and safe ways to pay, available with its latest app release. Clients now get up to 20% off when they spend their Discovery Miles online and in-store through the Bank’s partner network, and they enjoy greater convenience and security when shopping with virtual cards.

In a claim experience analysis, Discovery Group Risk today reported claim pay-outs to the value of R1.48 billion in the year to June 2020, including at least R100m directly due to COVID-19. The company offers group risk benefits that include life cover, global cover for the education of employees' children, severe illness cover, lump-sum and monthly disability protection, and funeral cover.

Discovery Health Medical Scheme members will be able to elect to have their health plan administered in accordance with principles that are compliant, through the Discovery Health Medical Scheme Shariah Compliant Arrangement.

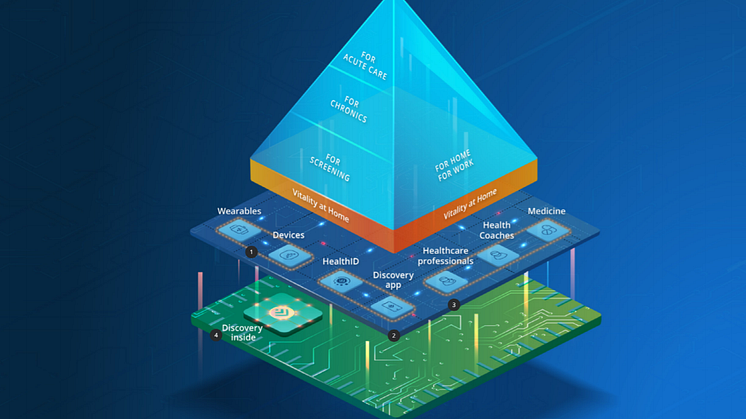

Discovery Health has invested extensively in a digital healthcare ecosystem to enhance the quality and experience of healthcare for members of DHMS. This investment includes the adoption and funding of digital healthcare technology, digital tools for members and doctors, integration with health monitoring devices and sophisticated data analytics.

“Each year we strive for the lowest possible contribution increase. For the first six months of 2021, DHMS will deliver a contribution freeze for all scheme members across all plans, mindful of and sensitive to the financial pressures facing individuals at this time within the country’s stressed economic climate.

JOHANNESBURG, 30 September 2020 | Discovery Vitality today announced an exciting series of product enhancements that will further motivate and reward members to get healthy by exercising and eating well.

Discovery Group Chief Executive, Adrian Gore, presented Discovery’s results for the year ended 30 June 2020 confirming the Group’s financial strength and strategic relevance.

Discovery presents new insights into the progress of the COVID-19 pandemic in South Africa and globally and investigates dynamic interventions that have saved lives and that have helped the country to navigate the peaks of the pandemic.

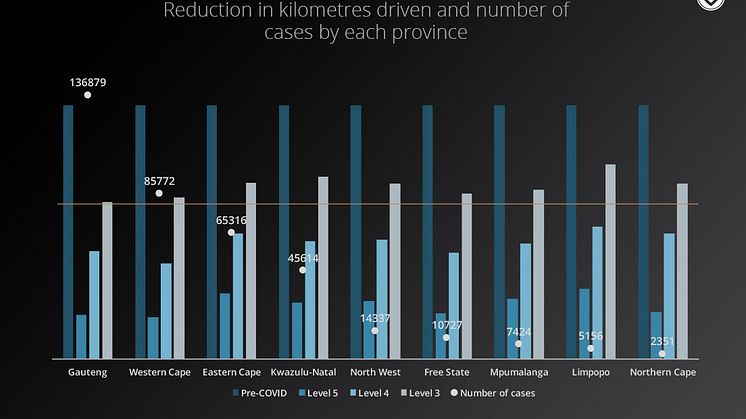

Analysis of Discovery Insure’s clients’ driving behaviour during the national lockdown indicates that its best drivers reduced their mileage by up to 89%, and younger drivers reduced their mileage more than older clients. The findings were issued today.

Discovery is pleased to announce the successful launch of its Vitality 65+ offering. Vitality members, 65 years or older, can now achieve better health with age-appropriate goals, interventions and activities, with exclusive enhancements to the Vitality programme, across Health, Insure, Life and Invest - that help them achieve better health with age-appropriate goals, interventions and activities.

Professor Harris has been a member of the Executive Committee of the International Actuarial Association since 2018 and among other roles, has served as the Chair of the Health and Education Committees of the Actuarial Society of South Africa, and as the President of the Actuarial Society of South Africa in 2016 and 2017.

During 2019, Discovery Life paid out R4.8 billion to policyholders, including a total of R1.2 billion through the PayBack benefit. In addition, Cash Conversions to the value of R2.8 billion are expected to mature over the course of the next 5 years. Breakdown per benefit: • R2.28bn in life cover • R1.1bn Severe Illness Benefit • R816m Disability benefit • R375m income Continuation Benefit

In line with National Savings Month, Discovery Bank will postpone implementing the interest rate reduction announced yesterday and will keep the interest rates on all its savings accounts as is for the next 14 days. The interest that Discovery Bank charges its clients on their borrowings will, however, be reduced with effect from July 24 2020.

Discovery Invest launched a greatly-enhanced global investment solution that uses shared value to create the world’s first exchange rate enhancer, and offers investment choices advised by BlackRock and Goldman Sachs, world leaders in asset management.

Discovery recognised as the recipient of the Gold Global Innovator Award at the 2020 Efma-Accenture Innovation in Insurance Awards, a virtual ceremony showcasing the best examples of insurance innovations across the globe.

Discovery Insure CEO, Anton Ossip, announced enhancements to Discovery Business Insurance’s offering, including a partnership with MTN to give businesses up to 50% back on their monthly data costs, capital support for the retail sector in partnership with Merchant Capital, as well as the Dynamic Distance Cash Back to reward people for driving less during the COVID-19 pandemic.

Discovery Insure's warranty product covers a comprehensive list of critical components, with no limits. This product encourages good driving with premiums based on a driver’s specific driving profile, as well as the unique circumstances of the vehicle compared to a market where premiums tend to be undifferentiated irrespective of how good a driver you are.