Press release -

Younger drivers reduced mileage the most compared to all age groups during lockdown – Discovery Insure data shows

Analysis of Discovery Insure’s clients’ driving behaviour during the national lockdown indicates that its best drivers reduced their mileage by up to 89%, and younger drivers reduced their mileage more than older clients. The findings were issued today.

“We were curious to see the effects of the national lockdown on our clients’ driving behaviours, and how this evolved as the country began to re-open. While we’ve all been watching the statistics associated with COVID-19 infection and mortality rates, our analysis reveals the impact of each phase of the regulations on driving behaviours,” says Discovery Insure’s Head of Technical Marketing and Vitality Drive engagement, Precious Nduli.

Kilometres driven is indicative of the economy re-opening

Discovery Insure assessed accumulated mileage among clients along personal and commercial lines, and segmented it into the various levels of lockdown as announced by the president: A pre-COVID-19 lockdown period between 2 and 26 March, followed by a level 5 period until the end of April, level 4 until the end of May and level 3 through the months of June and July.

During lockdown level 5, Discovery Insure clients only drove 13% of their pre-lockdown mileage and Discovery Business Insurance clients only drove 14% of their pre-lockdown mileage. This is indicative of the restrictions imposed during alert level 5 where people were not allowed to leave their homes unless under strictly specified circumstances such as shopping for essential items or essential work. Similarly, many non-essential businesses had to temporarily close.

“As expected, mileage driven by clients nationwide dropped significantly as the country entered lockdown level 5 and gradually began to pick up again in steady increments as we progressed to the next levels,” explains Nduli.

During lockdown level 3, while citizens were encouraged to remain at home as far as possible, many restrictions were lifted. Businesses were allowed to re-open, more people returned to work and started dining at restaurants again. This re-opening of the economy led to Discovery Business Insurance clients driving four times more than they did in lockdown level 5, even though they have not resumed their pre-COVID mileage. While Discovery Insure clients reduced their driving by 55% on average during lockdown level 3, it is encouraging that Discovery Business Insurance clients’ mileage indicates they had recovered to 58% of pre-COVID levels by the end of July, indicating increased economic activity.

Better drivers reduced their kilometres driven the most

“We have always seen that our better drivers are better risks as they have fewer and less severe accidents. This is reflected interestingly in the lowest mileage being driven by our better drivers during the various levels of lockdown over the last few months,” adds Nduli.

“Of all our Vitality Drive clients, our Diamond and Gold status drivers reduced their driving the most during level 5 – by as much as 89%. This has been sustained as lockdown restrictions have eased with Diamond status drivers still driving 57% less in lockdown level 3 than they did in the period before the pandemic. Our most conscientious drivers clearly heeded the call to limit public interactions.”

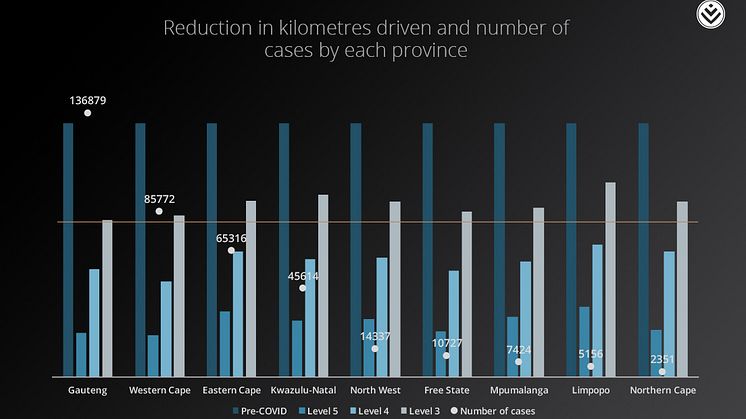

Interestingly, an increase in kilometres driven occurred alongside the increased number of infection cases in the Western Cape

“Between April and June, the Western Cape experienced a spike in infection rate cases. During this time, we noted a 70% increase in mileage driven even though community spread of COVID-19 was taking place,” she adds.

“In contrast, the Northern Cape accumulated the least overall mileage numbers with a small increase between level 4 and level 3. The province also recorded the lowest number of new infection cases.”

Mileage according to age and gender of drivers

Insure drivers under the age of 30 showed the most significant drop in mileage during lockdown level 5 between the end of March and through April.

“It’s interesting to see, considering the risks identified in the general population, that drivers over the age of 50 appeared to be driving more during level 4 and level 3, than our younger clients. We noted an increase of 48% in mileage driven in older age groups. Older individuals are known to be at higher risk of severe illness and are also among the majority of deaths recorded, and yet appear to have been moving around more during these months,” Nduli points out.

“We also noted a 43% increase in males driving during levels 4 and 3, even though within the country more men were recorded among South Africa’s mortality figures than women,” said Nduli.

Using telematics technology to introduce valuable and extensive premium relief

“Using our insights gained from our telematics data, we saw the opportunity to reward our clients through these changed circumstances. We introduced the Motor Premium Relief Benefit where clients could get a discount of up to 25% on the May vehicle premium based on how much they drove in April,” says Nduli.

Since kilometres driven remained low as the country progressed through levels of lockdown, Discovery Insure extended this premium relief to the Dynamic Distance Cash back benefit. Vitality Drive clients can receive a motor premium cash back of up to 25% based on the kilometres driven every month. This benefit is available throughout all levels of the lockdown, making it the most extensive premium relief offered by insurers to date.

In this way, the focus is on ensuring that car insurance cover for Vitality Drive clients is still rewarding while it’s necessary for their movements to be limited.

“Our hope is that lessons from this period and the evolution of driving behaviours in the post-lockdown world could contribute to enhancing and adapting our behaviourally-led driving programme in the months to come. For now, we hope that all of our valued clients stay as safe as possible while earning rewards through Vitality Drive,” Nduli concludes.

ENDS

Additional graphics are available on request.

For interviews or further enquiries please contact:

Shanti Aboobaker

ShantiA@discovery.co.za

Topics

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in 24 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA