Press release -

2019 Discovery Life claims insights and COVID-19 trends

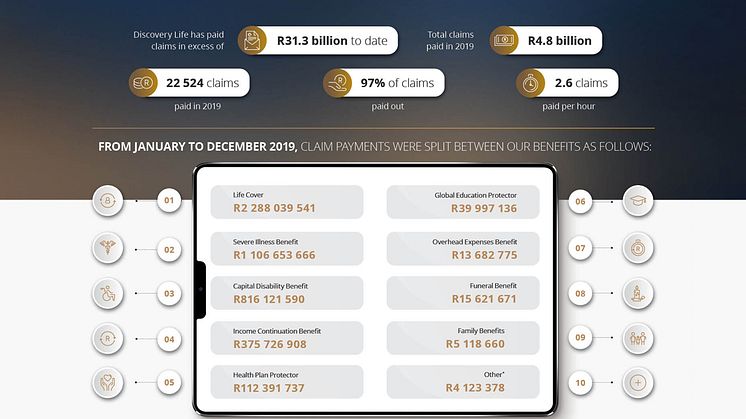

During 2019, Discovery Life paid out R4.8 billion to policyholders, including a total of R1.2 billion through the PayBack benefit. In addition to PayBacks, Cash Conversions to the value of R2.8 billion on our client’s Life Plans are expected to mature over the course of the next 5 years.

Since 2013, the leading causes of death in clients under 30 have been suicide and trauma, making up 68% of life claims. Of those claims, in 2019, 50% were a result of vehicle accidents.

- R2.28bn in life cover

- R39m in Global Education Protector

- R1.1bn Severe Illness Benefit

- R816m Disability benefit

- R375m income Continuation Benefit

- R112m Health Plan Protector

Discovery’s core purpose is to enhance and protect its clients’ lives. It strives to achieve this through the Shared-value Insurance model across all our businesses.“ Using the Vitality chassis, we incentivise clients to engage in healthy behaviours. Discovery Life takes this value proposition further and has designed its offering around the Vitality programme, enabling clients to derive value from products that traditionally only provide risk protection,” says Discovery Life deputy CEO, Gareth Friedlander.

“Shared-value Insurance is written in Discovery’s DNA. We speak of its importance to our business often and strive to find ways to make it impactful to every client, every day.”

Integration with Discovery Vitality promotes the achievement and maintenance of good health throughout clients’ lives.

“When policyholders do make efforts to live well, it shows in the stats and we’ve been able to reward them for it,” adds Friedlander. “During 2019, the business paid out policyholders a total of R1.2 billion through the PayBack benefit.”

Underpinned by the Vitality programme, policyholders earn their PayBack percentage according to their Vitality status and Discovery Health claims, where applicable. Policyholders can improve their status the more they engage with the programme. As a result, they can accrue a higher percentage of their premiums towards a PayBack amount. In this way, Discovery Life encourages policyholders towards goals of long-term health and reduced overall risk. The lower a person’s risk profile, the higher the PayBack.

“During 2019, one Diamond status policyholder earned nearly R937 000 in PayBacks. The highest PayBack to a Gold status client was over R650 000. Even for less-engaged members, we saw that during 2019, the highest PayBack to a client with a Blue Vitality status was in excess of R535 000,” adds Gareth Friedlander. In addition to PayBacks, Cash Conversions to the value of R2.8 billion on our client’s Life Plans are expected to mature over the course of the next 5 years.

“What we’ve been able to determine from our claims data is that in 2019, clients who achieved a Gold or Diamond Vitality status had a 53% lower mortality risk compared to policyholders who are not engaged in the programme,” adds Friedlander.

Performance of the shared-value during the COVID-19 pandemic

While life as we know it may have changed since the outbreak of COVID-19 in South Africa as well as the subsequent lockdown, Discovery has seen the virus amplify the effects of the Shared-value Insurance model. “Whilst Vitality is predominantly aimed at reducing the effects of non-communicable diseases, we see its effects playing out very strongly in the COVID-19 environment. On average, highly engaged Vitality members have an 11% lower risk of being admitted to hospital after being diagnosed with COVID-19. This almost entirely offsets the increased risk faced by clients aged 60 and older when compared to a 40-year-old client,” says Friedlander.

“Vitality has also been adapted to cater for the limitations of the lockdown with exciting new features such as Vitality at Home and the Virtual Run Series. Rewards such as flight discounts have been rechannelled into boosted Healthy Living discounts. This has all resulted in extremely positive outcomes and we’ve seen that 91% of highly engaged members have stayed active despite restrictions. There’s also been a 7% increase in the number of heartrate points-earning activities and approximately three times as much money is being spent on sports equipment since the lockdown announcement when compared to pre-lockdown,” he adds.

From a life insurance claims perspective, up to July 2020, 51 lump sum payouts have been made for death and severe illness cover, while 97 claims have been paid out on income and expense protection cover. We have seen 45% and 53% of Life Cover claims paid to people aged between 40 and 59 and over 60, respectively. Health professionals on the frontline of the fight against COVID-19 comprise the largest number of claims thus far, accounting for 65% of payouts.

Comprehensive cover is critical in the context of the COVID-19 pandemic

Friedlander says the COVID-19 pandemic has created unprecedented health challenges and has highlighted the need, not just now but also in the future, for a multi-organ failure claims assessment criterion.

“Under traditional insurance products, illnesses are assessed within ‘siloed’ body system categories and organ failure definitions have typically only focused on chronic long-term permanent failure. For an illness like COVID-19, that can create acute organ injury across multiple body systems, the shortfall in this siloed approach is that the impact on each body system in isolation may be insufficient, or that the impact may not be determined as permanent, which in either circumstance would not lead to a payment even though the impact on a client’s overall health is significant,” says Friedlander.

In response to this, Discovery Life has introduced a new multi-organ benefit category within our Severe Illness Benefits. The Multi-organ Benefit complements our existing severe illness body systems and provides payments that are assessed by the level of acute multiorgan failure, resulting in payments of 50–100% of a client’s severe illness sum assured. This claims category has a 14-day survival period and expires when a client turns 65. This benefit is available subject to underwriting to both new and existing clients.

This is no different to the entire product development process at Discovery Life where comprehensive risk protection is the foundation to any product. Our portfolio range is extensive, offering you the opportunity to build the most comprehensive Life Plan for yourself and your family. On top of this is an exemplary claims payment record, with over 98% of claims paid out.

2019 claims insights - over R31 billion paid out in just 20 years

“From January to December 2019, Discovery Life paid out R4.8 billion to clients,” says Friedlander. Cumulatively over the years, more than R31.3 billion has reached policyholders in their time of need.

“More than R2 billion in Life Cover was paid out to families following the loss of a loved one,” says Friedlander. To date, the oldest male client passed away at the age of 89 due to respiratory failure and the oldest female at the age of 86 as a result of a heart attack. The youngest male client passed away at the age of 23 in a motor vehicle accident, and the youngest female, at the age of 21, also in a motor vehicle accident.

“During 2019, we noted that cancer unfortunately remains the most common cause of death among female policyholders – particularly breast cancer. Male clients appear to be more at risk of death due to heart- and artery-related health conditions,” says Friedlander. “Men also appear to have a higher proportional risk of unnatural deaths, at 1.5 times that of women.”

Key trends

How has the claims experience changed over the years?

Discovery Life’s Chief Medical Officer, Dr Maritha van der Walt, noted that younger policyholders are seemingly at a considerably higher risk of unnatural death, mostly as a result of motor vehicle accidents, while older generations appear more prone to cancer and cardiovascular related health conditions.

Since 2013, the leading causes of death in clients under 30 have been suicide and trauma, making up 68% of life claims. Of those claims, in 2019, 50% were a result of vehicle accidents.

The good news is that members between the ages of 31 and 40 are at a lower risk of dying prematurely from heart-related conditions. When compared to claims from 2014 to 2016, heart and artery severe illness claims have fallen by 22% over the past three years among millennials.

Nearly 1 in 5 death claims made during 2019 were submitted due to unnatural causes. “Suicides are seemingly more prevalent in clients between the ages of 41 and 50. During 2019, however, we did note a 29% decline in the incidence rate when compared to figures recorded five years prior,” adds Dr Van der Walt.

Women of all ages are at risk of developing breast cancer. However, over the last four years, it has been the leading type of severe illness cancer (49%) in women between the ages of 51 and 60. While men are more likely to pass away from heart and artery conditions, cancer is the second leading cause of death. Prostate cancer is the most prevalent cancer in severe illness claims and accounts for 32% of male cancers in all age groups and 43% of male cancers in the 51-to-60 age bracket. Severe illness claims for prostate cancer have increased by 20% in the last three years, when compared to the prior three years.

In 2019, 22% of clients over the age of 60 who claimed from their Income Continuation Benefit were permanently disabled. This represents 57% of the total amount paid under the Income Continuation Benefit in 2019 which demonstrates the significance of Discovery Life’s 100% upgrade on permanent disability.

ENDS

Visit the Discovery Life Claims page here.

For further media enquiries: ShantiA@discovery.co.za

Topics

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in 24 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA