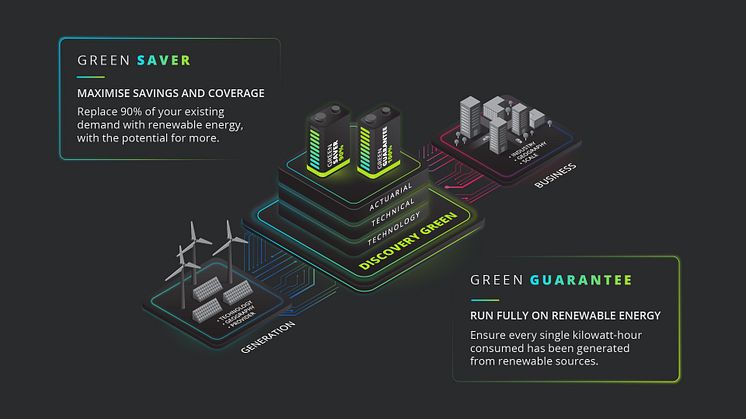

Discovery Green expands portfolio with renewable energy deals with Implats, KP Lime and leading hospitality brands

Discovery Green is pleased to announce the signing of five new clients in the mining, property and hospitality sectors, securing long-term partnerships with Impala Platinum Holdings Limited (Implats), KP Lime, The Capital Hotels and Apartments, Balwin Properties, and Fortress REIT Limited. The signing of these agreements aligns with Discovery Green’s mission to provide affordable and price-certain