Press release -

South African women need more income protection cover – and continue to see the value of cover for cancers

Johannesburg, 10 August 2022: Every year, in August, South Africa marks Women’s Day and Discovery Life undertakes to reflect on its efforts to close the gendered insurance gap in our country. In 2019, ASISA conducted a gap study which found that women have an insurance gap of nearly R15 trillion. An analysis of Discovery Life’s 2021 claims data shows that while women hold 47% of all life policies, the value of their cover is much lower than that of men and very few female clients have sufficient income protection. As expected, COVID-19 was the leading cause of claims for women in 2021, followed closely by cancer, highlighting the importance of regular screening but also the need for comprehensive cover for cancer.

“According to Statistics South Africa, 38% of South African households are singlehandedly headed by women. So, it is clear that South African women need to protect themselves with the correct financial products,” says Kashmeera Kanji, Discovery Life’s Head of Market Analytics and R&D. “Whether women have a role as a homemaker or an active earner in a household, they contribute directly to the financial wellbeing of their dependents and a life changing event affecting them could cause significant strain on the household finances,” explains Kanji.

In 2021, Discovery Life paid 3 523 claims to its female clients for life changing events, including R628 million worth of cancer claims being paid to female clients. Cancer accounted for 20% of all death claims, 27% of all disability claims and 50% of all severe illness claims for women. “Sadly, the most prevalent cancers – breast and ovarian cancer – have a high rate of relapse too, so we have designed a Severe Illness Benefit to protect our clients specifically against the trending risks of cancer incidence and relapse rates. We cover our clients comprehensively for cancer and we are incredibly proud that this benefit is chosen by so many women with more than half (57%) of our female clients having added our Severe Illness Cover to their policies,” says Kanji.

South African women face unique risks that compound the financial impact of a life changing health event. Several factors contribute to this. The World Economic Forum finds that South African women face higher unemployment rates than men despite there being more female graduates than males. Women are also more likely to commit to non-income generating tasks in a household, meaning that they spend less time in the workforce. South African women, on average, also live nearly six years longer than South African men, meaning that we are likely to spend six more years in retirement. “Collectively, this underlines the importance of women protecting their ability to earn an income, because it creates the resilience needed to tide these gaps,” says Kanji.

Kanji encourages women to consider protecting their financial wellbeing through various financial products, particularly life insurance that includes income protection. “While women accounted for nearly half of the number of income claims in 2021, these claims made up only 31% of the Rand amount paid.” This is likely explained by the gender wage gap, which might also be affecting the levels of cover seen on other benefits. Some 47% of all policies at Discovery Life are owned by women but the value of their cover is much lower than that of men. In 2021, 30% of all life cover claims were for women, yet these accounted for just 19% of the total amount paid to beneficiaries.

“Understandably, women are looking to access the most comprehensive, relevant, and affordable cover for themselves, and we encourage them to take advantage of Discovery Life’s shared-value model to monetise their engagement in Vitality, improve their health, and generate savings through their life insurance policies. To date, our clients have received over R9 billion in PayBacks, an amount that I’m sure will go a long way in improving the financial futures of our clients,” concludes Kanji.

Sources:

WEF Global Gender Report 2022: pp.318 and 319

IOL: Life Expectancy of male vs female South Africans

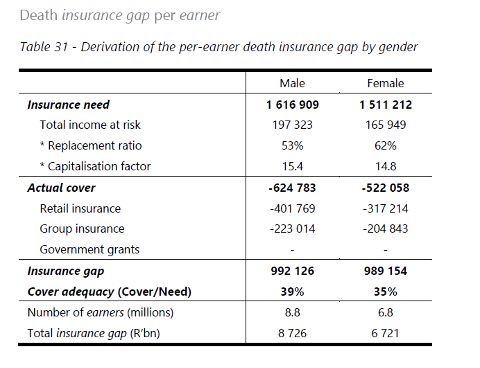

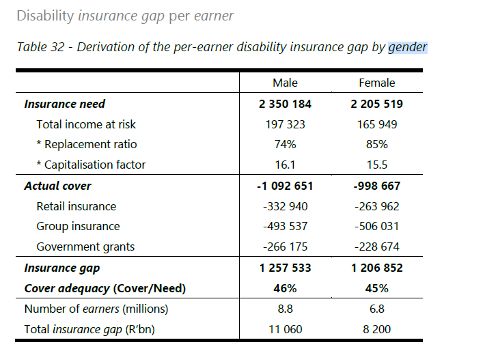

ASISA Gap Study 2019: see Table 31 (Derivation of the per earner death insurance gap by gender) and Table 32 (Derivation of the per-earner disability insurance gap by gender)

Topics

Categories

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, banking, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in over 35 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA