Press release -

South African spending remains resilient with strong adoption of digital wallet use compared with global peers: SpendTrend24 report

Johannesburg, 4 April 2024 – Discovery Bank and Visa today released their latest SpendTrend24 report, a comprehensive study of consumer spending habits. This latest report is based on over 13 billion transactions made on more than 60 million credit cards from 14 cities around the world, including three South African cities, five emerging market cities, and six developed market cities, from 2019 to 2023.

The SpendTrend24 report builds on the learnings of the 2023 edition to uncover interesting insights into consumer behaviours, emerging trends, and the evolving expectations of consumers in an ever-changing economic landscape. It highlights the growth in online and digital transformation, which has opened opportunities for economic growth and financial inclusion.

Key findings in the SpendTrend24 report include:

- Global consumer spending and saving habits are evolving, focusing on budgeting, value and trade-offs amid rising interest rates. Consumers are clearly becoming more cost conscious and cautious about their spending habits as global nominal disposable income growth was constrained by rising inflation rates. In response to the financial pressure of higher interest rates, consumers are changing how they spend and save money.

- Despite a challenging macro-economic environment, South Africa has proven to be highly resilient compared to global peers based on spend data. South African cities showed more stable year-on-year spend patterns and less segment volatility compared with many global counterparts. South African consumer expenditure growth stabilised in 2023, lagging inflation by two percentage points.

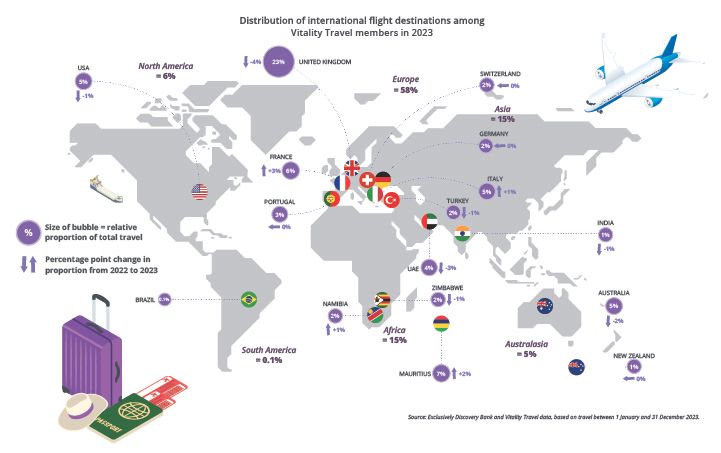

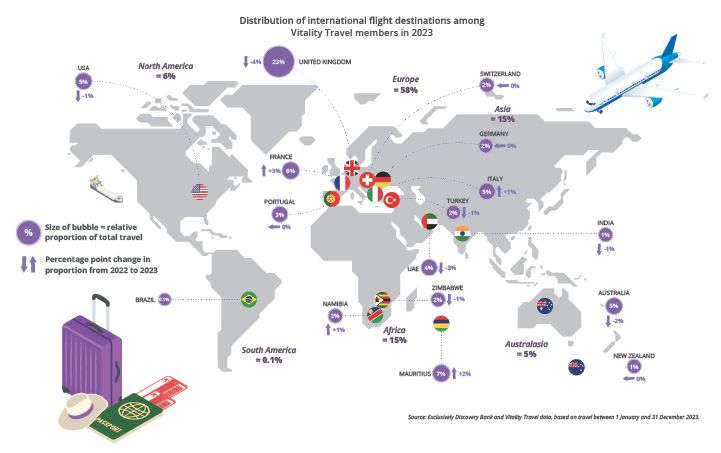

- Groceries, retail, travel and fuel make up nearly two-thirds of South African spend. Overall, emerging market cities spend a higher share on groceries and fuel, and a lower share on travel compared to developed market cities, which also spend a higher share on eating out and takeout. Global travel volumes have largely returned to pre-pandemic levels, but at a higher cost, indicating a recovery in the travel industry with evident inflationary pressures.

- Variances exist in share of category spend across markets and segments. Spend increased among the affluent and high net worth segments worldwide, with the mass segment experiencing modest growth or even declines. Choices appear to be made between affordability and convenience, with segments and markets differing in their share of spend on groceries, eating out and takeout, and travel.

- The benefits and increased security of digital payment options are driving rapid adoption globally, with consumers in global cities increasing their use of digital wallets and online purchases. South Africa benchmarks well against global counterparts, with an impressive nine percentage point increase in digital wallet usage over the last year.

Hylton Kallner, Discovery Bank CEO, says, “Our latest research highlights that throughout 2023, global economies navigated a complex path of post-pandemic revival, framed by persistent inflation and high interest rates. These challenges pushed up the cost of living, prompting consumers to adjust their spending habits. The analysis allows us to explore the effects of these challenges and to compare the spending patterns of typical South Africans and Discovery Bank clients with those of other emerging and developed markets. This comparison highlights South Africa’s economic resilience. The report confirms that, South African cities demonstrate more stable spending patterns year-on-year and less fluctuation in spending across different market segments compared to cities in emerging and developed countries.”

Lineshree Moodley, Country Manager for Visa South Africa, says “Visa is delighted to partner with Discovery to share insights from the latest SpendTrend24 report. Despite economic challenges, South Africa has shown remarkable resilience. The launch of SpendTrend24 charts the path forward in our digital economy, and we firmly believe that with the valuable data and foresight provided by the research; individuals, businesses and economies are empowered to innovate, foster financial inclusion and drive meaningful change in the face of evolving consumer demands and business needs.”

Highlights on spend, what people purchase and how they pay

How much people spend

- Personal consumer spending growth in South Africa steadied in 2023 after the surge seen in post-pandemic spending in 2022.

- While consumer spending in South Africa outpaced inflation by 19 percentage points in 2022, the growth in consumer spending closely matched inflation in 2023.

- Spend on food, including groceries, takeout, and dining out, has generally increased in most cities.

- In emerging markets, a larger part of the budget goes to essentials like groceries and fuel, with less spent on non-essentials like travel.

What people spend on

Around the world, people differed in what they spend money on as a percentage of their total spend.

- In developed market cities, share of spending on travel is twice as much compared to emerging market cities (excluding Lagos and Accra).

- In the past year, average grocery spending in South Africa rose by 8%, compared to the 16% increase the year before. This was influenced by high food inflation rates of 12% and 11% over the last two years, respectively. In South Africa’s market segments, grocery spend growth ranged from 0% in the mass segment to 8% in the high net worth segment. This is consistent with the view that the mass segment has adjusted their purchasing habits or bought less to cope with rising costs – likely worsened by more of their disposable income being used to repay debts, due to higher interest rates.

- Spending on eating out and takeout also increased in the last year by 8%, following a 28% surge the year before, driven by post-pandemic recovery. However, 70% of South Africans surveyed in 2023 say they cook or bake a prepared meal at least once a week, and 37% said they would pay more for healthy and nutritious food options.

- Travel utilisation is returning to normal – but is costing more, for everyone. After a surge in ‘revenge-travel’ following the pandemic, South Africans’ travel habits have settled. However, the cost of travel is now higher than before.

- South African fuel prices were 1.5% higher in 2023 compared to 2022. On average, Discovery Bank clients spent more refueling their tanks than other South Africans. This may be in part due to the effective reduction of fuel costs by up to 20% with Vitality Money, and the extra up to 50% savings for Vitality Drive members.

How people pay

- South Africans are increasingly using their mobile phones to pay instead of physical wallets, with adoption rates matching or surpassing those of international cities.

- The growth of South African online spend in 2023 outpaces in-store growth by five times. South Africans are increasingly shopping online, surpassing other emerging market cities and keeping pace with developed ones.

Read all the findings, interesting spend, travel and payment insights, and expert predictions for 2024 from Visa and Discovery Bank. Download the full report and infographics here.

Notes to editors:

SpendTrend24 analysed spending data from 14 cities around the world, including three South African cities, five emerging market cities, and six developed market cities.

South Africa's cities:

- Cape Town

- Durban

- Johannesburg

Emerging cities:

- Accra, Ghana

- Ho Chi Minh, Vietnam

- Lagos, Nigeria

- Rio de Janeiro, Brazil

- Sao Paulo, Brazil

Developed cities:

- Barcelona, Spain

- Lisbon, Portugal

- London, United Kingdom

- Los Angeles, USA

- San Francisco, USA

- Sydney, Australia

Related links

Topics

Categories

Discovery information

About Discovery Bank

Discovery Bank is part of Discovery Limited, a financial services organisation that operates in healthcare, life assurance, short-term insurance, investments, banking, and wellness industries, in over 40 markets globally. Built on a shared-value model, Discovery Bank is fundamentally designed to create unique shared value for clients, differentiating the Bank from traditional banking models. Clients are encouraged to manage their money well, monetising healthy financial behaviours that lower their financial risk and realises long-term default and risk savings for the Bank. Discovery Bank shares this value with clients in the form of better interest rates, deep discounts and significant rewards from an exclusive retail, lifestyle and wellness partner network. The model has an overall positive impact on clients, society and Discovery Bank - clients experience greater financial wellbeing, the risk of defaults for Discovery Bank is lowered making the business more sustainable; while improved financial behaviours such as increased savings, higher retirement savings and lower debt levels, benefit society as a whole. Behaviour change and rewards are enabled through Vitality Money, an AI-powered programme on the Discovery Bank app that gives clients an understanding of the behaviours that influence their financial wellbeing, while giving them the tools to improve their financial behaviours. The more clients improve their financial behaviour, the higher their Vitality Money status and the greater the value they receive.Follow us on Twitter @Discovery_SA