Press release -

SAFx Rater confirms Discovery Bank’s new-generation forex account offers a unique experience

Johannesburg, 17 March 2022 – Discovery Bank today released its inaugural “SAFx Rater”, a comparative analysis of features and benefits of forex accounts offered by major banks and forex providers in South Africa. With the recent strengthening of the rand against major currencies, there has been significant interest in opening foreign exchange accounts to take advantage of this. Discovery Bank has conducted an analysis to benchmark all the offerings available to retail consumers in the market.

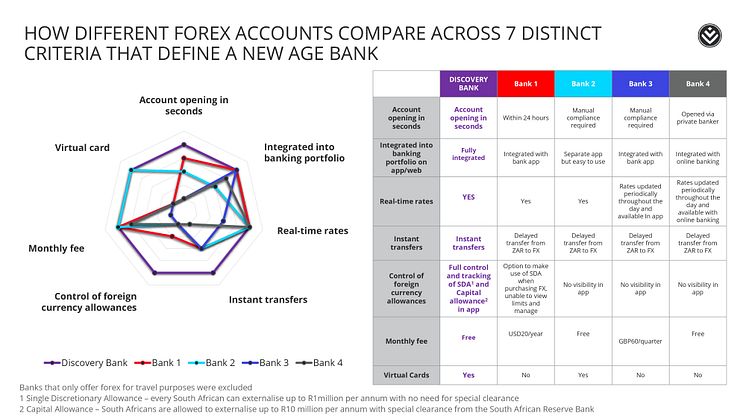

The SAFx Rater reviewed the forex accounts available from Discovery Bank and four leading South African banks against the following seven distinctive elements that define a new generation forex account:

- Easy access and the ability to open an account in seconds.

- Seamless integration in the banking platform with full visibility of all accounts.

- The best real-time buy and sell rates 24/7.

- The ability to instantly transfer funds into foreign currency and back into rand.

- Full control to manage foreign currency allowances in real time.

- Competitive fee levels.

- Virtual cards with immediate transactional capabilities.

Hylton Kallner, CEO of Discovery Bank said, “We looked at every element of what would make an account efficient, cost-effective and simple to open and use – from origination to transactions all the way through to tracking and reconciliations. In this market comparison of various forex accounts, only three banks in South Africa offer real-time forex rates in their app. We confirmed our rates to be among the best available across these and, in addition, meeting all seven metrics in the comparison, truly placing Discovery Bank’s forex accounts in a category of its own.”

Discovery Bank is the only bank to meet these seven distinctive criteria that define a new generation forex account

As a recent entrant into this market segment, Discovery Bank set out to create the first new generation forex account in South Africa. The results of the analysis, released today, indicated that while most banks’ forex offerings include some of the aspects of what a new generation forex account should offer, only Discovery Bank’s forex accounts met all the criteria included in this new analysis, at the lowest cost for clients. Since launching its forex capabilities in February, the Bank’s clients have already taken advantage of the functionality to open over 7 000 new forex accounts and made R50 million in deposits across multiple currencies.

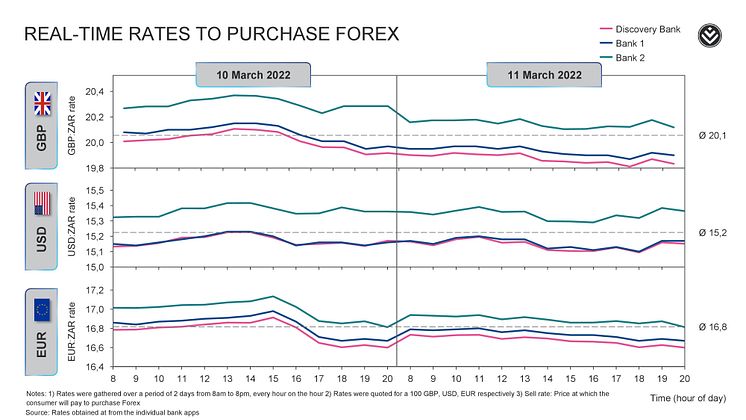

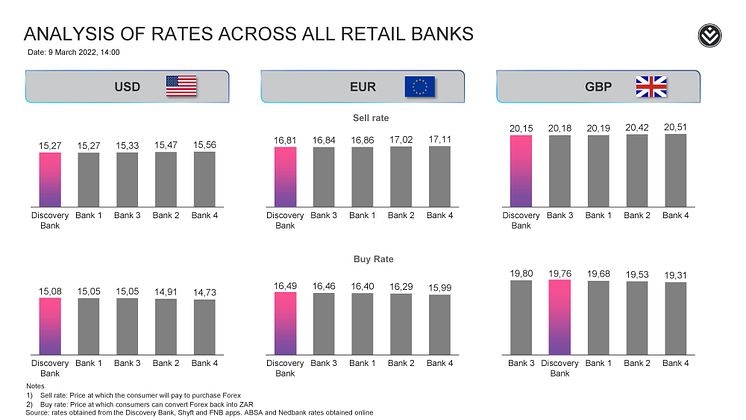

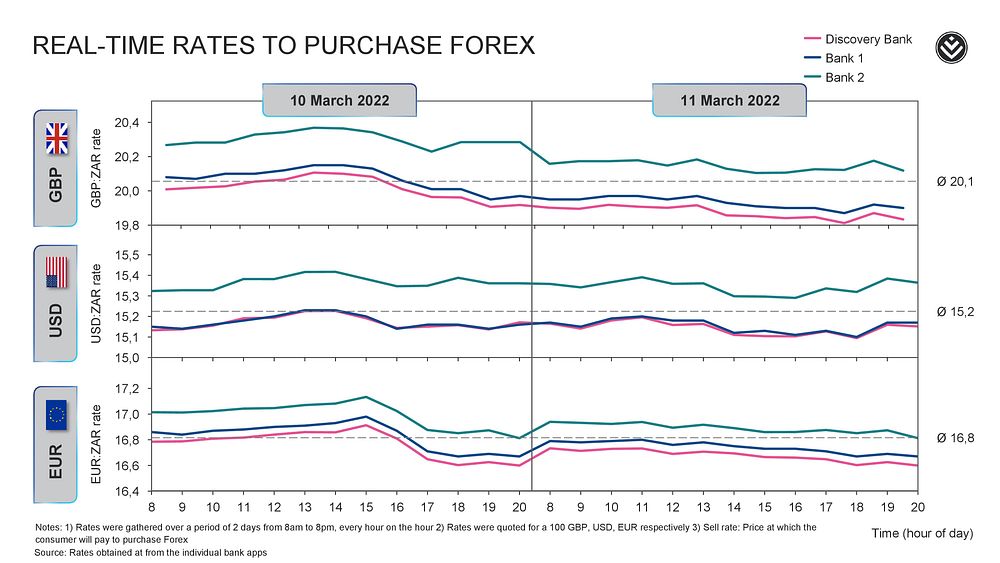

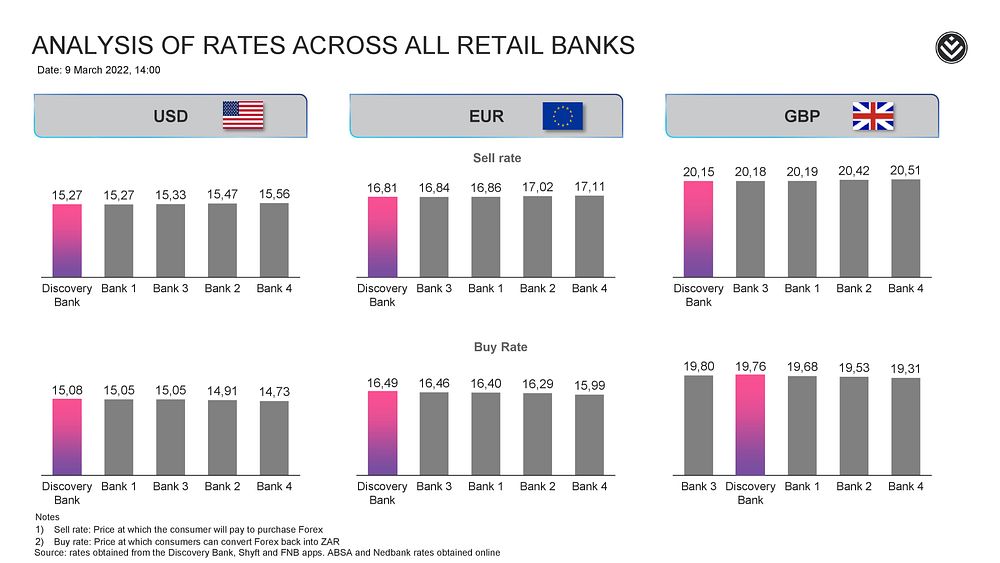

Discovery Bank also benchmarked the rates offered to purchase 100 GBP/Eur/USD every hour on the hour from 08:00 to 20:00 over a two-day period on 10 and 11 March 2022. The following chart shows the rate clients would pay for foreign currency at the three banks that have real-time payments and reveals that Discovery Bank consistently offered its clients the best rates at the lowest spread.

Furthermore, when compared against banks that do not offer real-time rates or transfers, Discovery Bank, along with the other two banks that offer real-time rates, still offer more competitive purchase rates reflecting the benefits of real-time transactions in the fluid market.

Kallner says technology and fintech developments have made it easier for people to navigate almost every aspect of financial services through apps or smart devices.

“One such aspect, is accounts for foreign currency trading, saving, and payments – all valued services in a world that is getting smaller. Considering the changing needs and demographics of banking clients, our development of forex accounts really looked to define and incorporate functionality that placed Discovery Bank’s forex accounts in a completely unique category; a new-generation account that meets every need.”

“I am pleased that our inaugural SAFx Rater covering the seven key elements of forex capabilities shows, across the board, that Discovery Bank forex accounts are leading in terms of ease of access, convenience, functionality and competitive rates to currently make it the most comprehensive and competitive forex account in the market,” he said.

“We have worked hard to ensure that we offer clients comprehensive forex accounts that provide best-in-market services and rates. With these accounts, our clients have all the major benefits and functionality to seamlessly connect to world currencies; to pay for services in more than 60 currencies and to save and transact in euro, British pound, and US dollar directly from their Discovery Bank app in real-time, whenever they want and wherever they are,” Kallner added.

ENDS

About Discovery Bank

Discovery Bank is part of Discovery Limited, a financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness in over 35 markets. Discovery Bank is fundamentally designed differently through its shared-value model. Clients create value as they manage their money well, which Discovery Bank shares back with them through better interest rates, deep discounts, and significant rewards. The overall outcome is that clients experience greater financial wellbeing, it reduces the risk of defaults for Discovery Bank making the business more sustainable, and it addresses large-scale challenges, such as increased savings, that benefit society at large. Behaviour change and rewards are enabled through Vitality Money, an AI-Powered programme on the Discovery Bank app that gives clients an understanding of behaviours that influence their financial wellbeing and how to manage their money. The better clients do, the higher their Vitality Money status and the greater the value they receive.

Topics

Categories

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in 27 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA