Press release -

Road safety in peril: Cellphone distractions are the biggest culprit, unveils Discovery Insure

Cellphone distractions now top the list of risky driving behaviours in South Africa, new research by Discovery Insure reveals.

Discovery Insure revealed findings of its recent study at the UN launch event of the UN-JCDecaux campaign for road safety held last night at Discovery’s office in Sandton. The launch in South Africa of the UN Global Campaign for Road Safety, in partnership with JCDecaux, is part of UN efforts to raise public awareness of life-saving initiatives on the road.

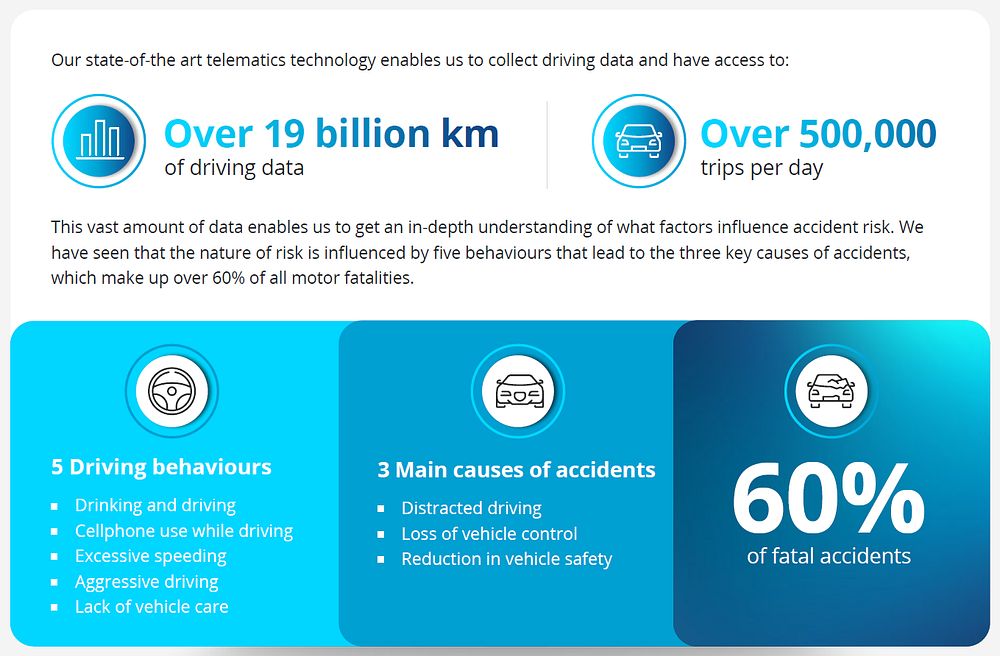

Speaking about Discovery Insure’s efforts to improve road safety in South Africa, Discovery Insure CEO, Robert Attwell said that the short-term insurer has access to over 19 billion kilometres of driving data with 500,000 daily trips, which enables them to get an in-depth understanding of factors influencing vehicle accident risks.

This data shows that while environmental factors like road conditions, and vehicle factors contribute to road fatalities; human factors like driver behaviour play the biggest role. Notably, the data revealed that cellphone distractions are the biggest contributor to road accidents in the country.

The research shows that over 60% of motor vehicle fatalities are influenced by five behaviours – drinking and driving, cellphone usage while driving, excessive speeding, aggressive driving, and lack of vehicle care.

“Discovery Insure’s investment in telematics has been critical in unlocking key insights that enable us to create a nation of safe drivers,” said Attwell.

Cellphone usage has become worse than speeding

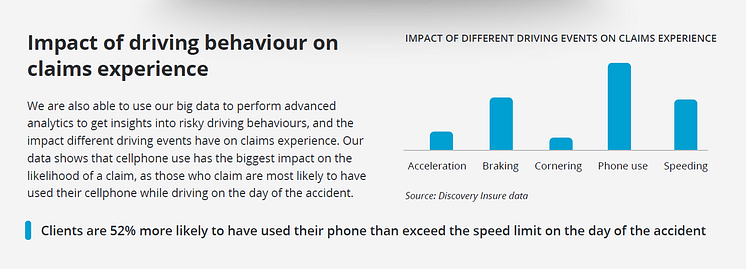

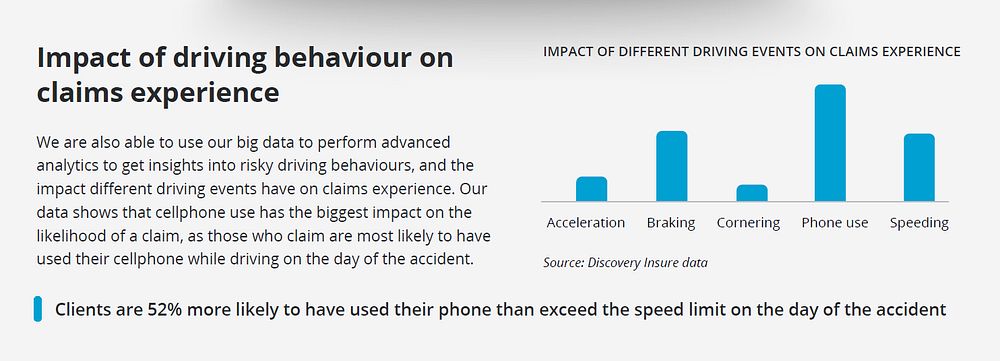

Data showed that cellphone usage has the biggest impact on the likelihood of a claim, even higher than speeding. A mere 20 seconds on the phone in each trip increases accident risk by over 60%.

Discovery Insure’s clients who submitted accident claims were 52% more likely to have used their phone than exceeded the speed limit on the day of the accident.

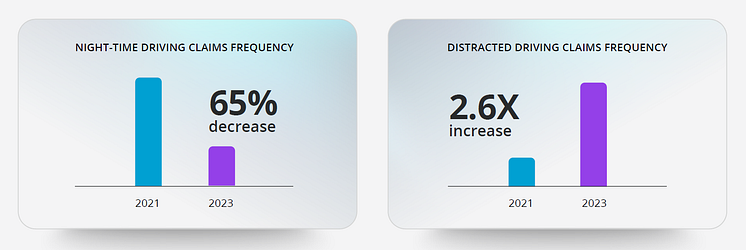

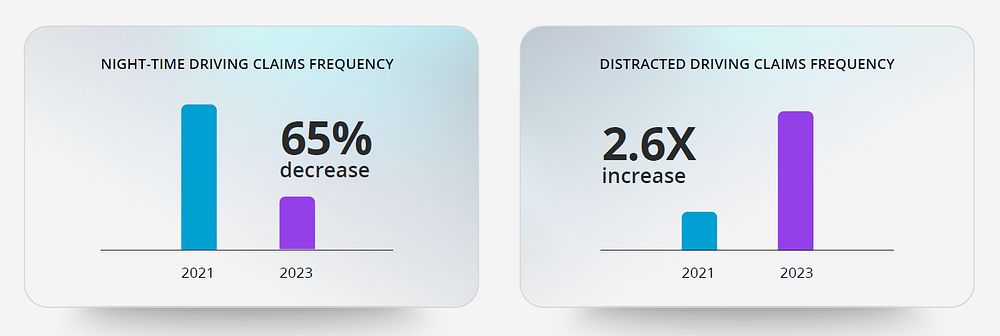

There is a shift to increased distracted driving accidents and less night-time accidents

Data also showed that driving at night significantly increases the risk that an accident is fatal as night-time accidents, happening between 10pm and 4am, are nine times more severe than daytime accidents. In addition, there has been a shift in driving behaviour with an increase in accidents relating to cellphone usage, while night-time accidents have reduced.

“We’ve seen a positive development as far as night-time accidents are concerned, which was partly attributed to increased usage of our Uber benefit. But now the increase in distracted driving accidents overshadows that,” said Attwell.

The state of South African roads

South Africa’s deteriorating road infrastructure also contributes to the risk of road fatalities and economic losses. The Road Traffic Management Corporation (RTMC) reported that poor road conditions accounted for 22.2% of motor vehicle fatalities in 2022. It estimated that they caused a 3.29% or R200 billion loss to the GDP that year.

“Combining these insights with our driving data, we can see that driving behaviour has a bigger impact on road fatalities than road conditions. The data shows that parts of the country with the best roads may have high motor vehicle fatalities because of bad driving behaviour,” added Attwell.

Limpopo has one of the best roads, but drivers in that province have the highest number of driving events that cause accidents. They exceed the speed limit significantly. Limpopo's road fatality rate per registered vehicle is the highest in the country. On the other hand, the Western Cape has good road infrastructure and good driver behaviour. This has led to lower road fatalities.

“This shows that road safety is a complex problem in South Africa, and it requires a multifaceted approach that largely drives a change in driver behaviour,” said Attwell.

Also emerging from Discovery Insure’s research and deeply concerning is that accidents usually occur on the same roads or intersections, with 1% of locations being where 27% of accidents occur. So, key interventions at these locations can help to improve road safety.

Vitality Drive proves successful in changing behaviour

The Vitality Drive programme aims to create safer drivers. Data shows that drivers on the programme reduce their accident risk by 15% within the first month of joining the programme, and they have a 34% lower fatality rate than the South African average.

The programme’s telematics technology helps drivers understand the good driving behaviours that will increase their rewards. So, they adapt behaviours. The more they engage with the programme, reaching the highest Vitality Drive status, their frequency of accidents reduces by 70% and accident severity drops by 35%.

Discovery Insure expands initiatives to creates safer drivers and safer roads

Discovery Insure has applied insights from Vitality Drive to address the problem of potholes in Johannesburg. It launched Discovery Pothole Patrol in May 2021, in partnership with the Johannesburg Road Agency, and recently, Avis Southern Africa.

Attwell explained, “Through the Discovery Pothole Patrol, we can participate in improving road conditions and reduce road hazards by repairing potholes. Since its launch, the Discovery Pothole Patrol has fixed over 220,000 potholes, resulting in estimated savings of over R33 million to Discovery Insure and bringing much value to all road users in Johannesburg.

Creating safer pedestrians: Making scholars’ journey to school safer with scholar transport intervention

Children are often involved in car crashes as pedestrians on the road, usually on their way to school. In The National Household Travel Survey (NHTS) for 2020, it was reported that about 10.1 million learners walked all the way to their educational institution in all nine provinces citing reasons that the school is nearby or close enough to walk from home; public transport was too expensive and transport not available.

Discovery launched Discovery Safe Journey to School (DSJTS) in partnership with Afrika Tikkun to improve pedestrian safety especially for children and to provide safer scholar transport.

“The DSJTS programme has transported over 18,000 children safely to and from school in 2023. The programme has also recorded no fatalities since inception,” added Attwell.

Committed to shared-value initiatives

Attwell added that Discovery Insure is constantly looking to enhance its Vitality Drive programme rewards to encourage behaviour improvement. It's encouraging to see the positive impact of Pothole Patrol, which is only in Johannesburg for now, and the Western Cape-based Safe Journey to Schools programme.

“We will always look for initiatives that are most impactful to the area to reduce risk and have a positive societal impact. The Discovery Pothole Patrol helps to create safer roads for all road users, and Safe Journey to School creates safer pedestrians, namely learners. We believe that expanding these initiatives will help to create safer drivers, safer roads, and safer pedestrians in South Africa,” concluded Attwell.

Commenting on the launch of the UN Global Campaign for Road Safety, United Nations Secretary-General's Special Envoy for Road Safety, Jean Todt said, “Africa is the continent most affected by road crashes. Knowing that these affect the youngest first, it is beyond the human tragedy, an economic devastation sacrificing or invalidating for life the active force of a country. While the vaccine to avoid this carnage on the road exists, I urgently call on everyone to use it."

Topics

Categories

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, banking, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in over 40 markets with over 40 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA