Press release -

Rewarding positive behaviour with over 10 billion Ðiscovery Miles in 2024

Johannesburg, 30 July 2024 – Discovery, today, released a paper on the value Discovery Vitality members get from Ðiscovery Miles, the currency used to give clients rewards for positive behaviours across the integrated Health, Drive and Money behaviour-change platforms.

Highlights from the research:

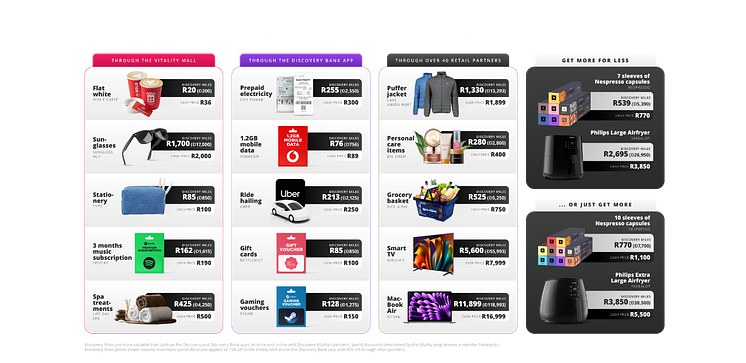

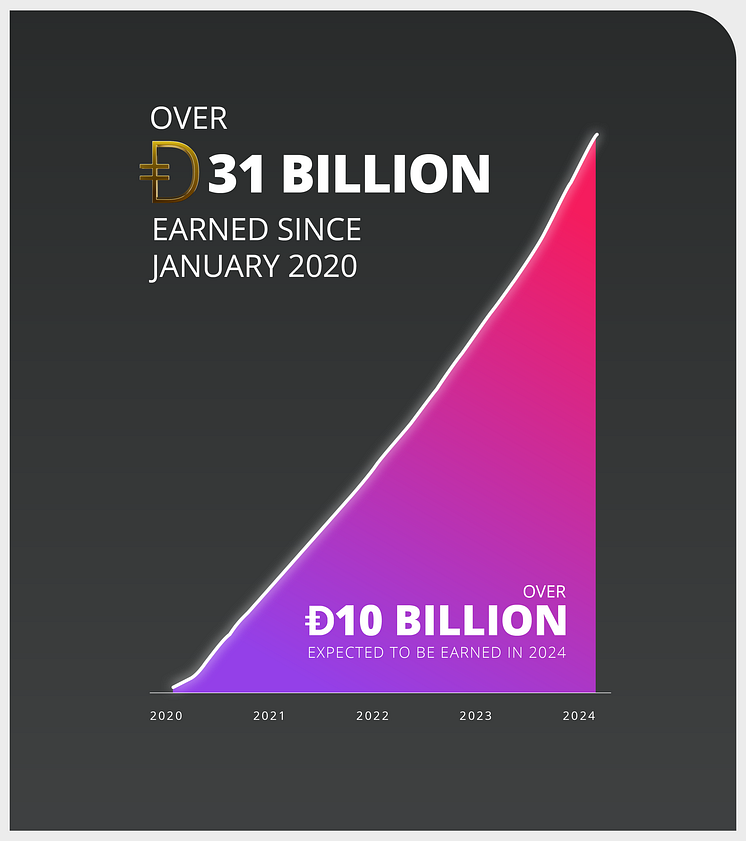

- In 2024 alone, Discovery Vitality members are expected to earn more than Ð10 billion with a redemption value of R1.0-R1.4 billion. The additional discounts when clients make purchases with Điscovery Miles, makes the rewards currency more valuable than cash.

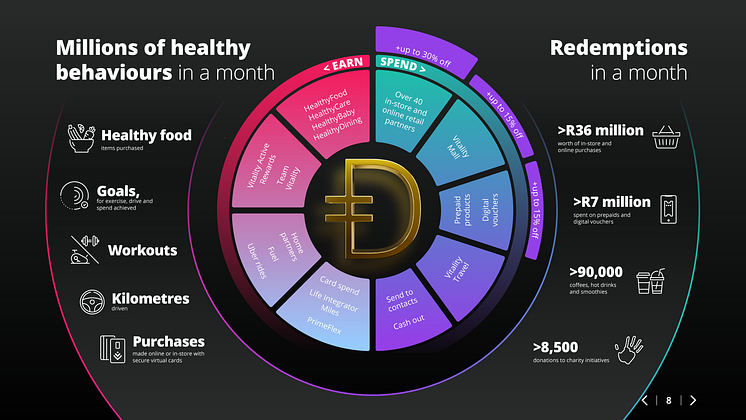

- Members earn Ðiscovery Miles from millions of Healthy food items purchased, workouts, driving well, weekly exercise, drive and financial goals.

- Over a year, members redeem billions of Ðiscovery Miles on over 1 million coffees and smoothies, on over 100,000 donations to charity initiatives, and to fund over 1 million local and international flights.

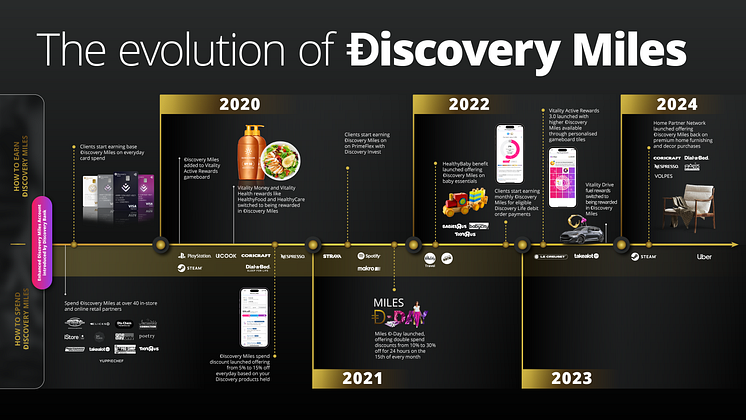

- Discovery Bank opened its virtual doors through the Discovery Bank app in 2019 and, since January 2020, banking clients have earned more than Ð30 billion (Ð: Discovery Miles).

Dinesh Govender, CEO of Discovery Vitality, says, “The evolution of Vitality rewards, shifting from cash-back to rewarding members for healthy behaviours in Ðiscovery Miles, has given us the opportunity to fully leverage the power of our rewards ecosystems, Vitality partner network and Discovery Bank to supercharge the value derived.

“Members currently benefit from popular Vitality Travel savings, discounted spend at over 40 in-store and online retail partners, and unique savings on Miles D-Day (the 15th of every month). We are now introducing new deals in the Discovery app which can be redeemed every week on #RewardsWednesday with rewards for up to half the price, over those 24 hours. This will include special discounted voucher deals in the Vitality Mall in the Discovery app that members can enjoy each #RewardsWednesday,” he added.

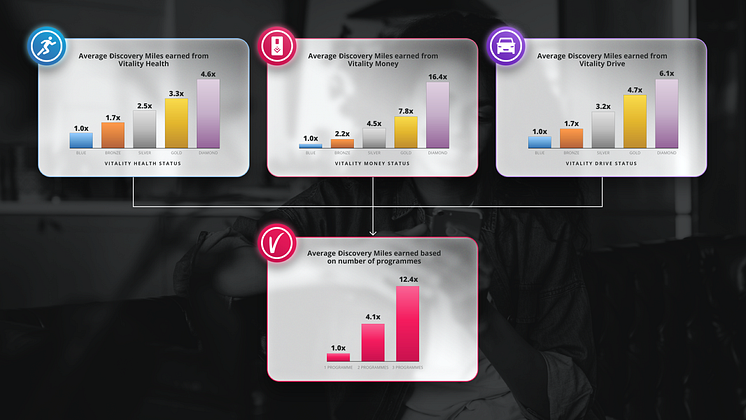

Discovery’s shared-value approach shows that incentivising members for improving their health correlates directly with increased rewards. Unlike traditional rewards programmes, which focus mostly on product uptake and brand loyalty, Discovery incentivises positive behavioural changes that improve overall wellbeing.

Within each of the three Vitality programmes (Health, Drive and Money), members are given a status of Blue, Bronze, Silver, Gold or Diamond. Each status shows how well the members manage key behavioural risks related to their physical and financial health, as well as their driving habits. This structured status system not only tracks progress but also motivates members to sustain and improve healthy behaviours. The integrated design of the Vitality programmes leads to greater benefits, with members earning more Điscovery Miles when taking part in multiple behaviour-change initiatives.

Hylton Kallner, CEO of Discovery SA and Discovery Bank, says, “Ðiscovery Miles is one way we drive engagement in and reward our clients for these positive decisions. This is why the integration of Discovery Bank with the behaviour-change platforms, makes it possible for clients to earn even more Ðiscovery Miles for multiple behaviour-change initiatives. As a Bank, we can create meaningful engagements linked to the rewards currency that gives our clients the ability to get more value than they would with cash.”

Read the Ðiscovery Miles paper for case studies on how they are more valuable than cash.

ENDS

Notes to editors:

Many ways to earn

Discovery has introduced a range of different ways that Vitality members can earn Điscovery Miles through their healthy behaviours and financial engagements across its comprehensive business suite – including banking, investments, short-term insurance, life insurance, health services and Vitality. Members have many opportunities to earn Điscovery Miles through a variety of daily activities, some of which start even before they wake up. They can earn Điscovery Miles through:

- Keeping active and achieving their exercise goals

- Driving responsibly

- Buying healthy groceries, personal care items and baby essentials, as well as household luxuries and premium furnishing

- Paying for fuel and Uber rides

- Using a Discovery Bank card, investing for the long-term and paying for life insurance policies to protect themselves and their loved ones.

- More than 40 in-store and online retail partners, covering categories like food, healthcare, beauty, clothing, electronics and technology, sports gear and more.

- Digital vouchers and discounted prepaid products and services.

- Local and international travel, including flights, car hire, accommodation and experiences.

- Donations to charities, extending the shared-value reach even further.

- Transfers to other Discovery Bank clients.

- A cash-out option to monetise Điscovery Miles into a Discovery Bank account, including the Điscovery Account with zero-monthly-fees.

Diverse ways to spend

Vitality members can redeem their Điscovery Miles in the Discovery app, the Discovery Bank app, and on the Vitality Travel website, accessing:

Vitality members can redeem their Điscovery Miles in the Discovery app, the Discovery Bank app, and on the Vitality Travel website, accessing:

- More than 40 in-store and online retail partners, covering categories like food, healthcare, beauty, clothing, electronics and technology, sports gear and more.

- Digital vouchers and discounted prepaid products and services.

- Local and international travel, including flights, car hire, accommodation and experiences.

- Donations to charities, extending the shared-value reach even further.

- Transfers to other Discovery Bank clients.

- A cash-out option to monetise Điscovery Miles into a Discovery Bank account, including the Điscovery Account with zero-monthly-fees.

Related links

Topics

Categories

Discovery information

About Discovery Vitality

Vitality is part of Discovery Limited, a worldwide insurer and investment manager impacting more than 30 million lives in over 40 markets, across Europe, the Americas, Asia, Africa and Oceania.

Vitality pioneered the ‘shared-value’ insurance model, a unique approach based on the scientifically proven principles of behavioural economics. Through this model, Vitality helps members take a more active role in managing their own wellness, encouraging them to develop healthy long-term habits that are good for them, good for the company and good for society.

The effect is positive for all stakeholders – members benefit from better health, financial rewards and additional incentives; employers benefit from healthier, more productive, and more engaged employees; and Vitality benefits from a healthier membership base.

About Discovery Bank

Discovery Bank is part of Discovery Limited, a financial services organisation that operates in healthcare, life assurance, short-term insurance, investments, banking, and wellness industries, in over 40 markets globally.

Built on a shared-value model, Discovery Bank is fundamentally designed to create unique shared value for clients, differentiating the Bank from traditional banking models. Clients are encouraged to manage their money well, monetising healthy financial behaviours that lower their financial risk and realises long-term default and risk savings for the Bank.

Discovery Bank shares this value with clients in the form of better interest rates, deep discounts and significant rewards from an exclusive retail, lifestyle and wellness partner network. The model has an overall positive impact on clients, society and Discovery Bank - clients experience greater financial wellbeing, the risk of defaults for Discovery Bank is lowered making the business more sustainable; while improved financial behaviours such as increased savings, higher retirement savings and lower debt levels, benefit society as a whole.

Behaviour change and rewards are enabled through Vitality Money, an AI-powered programme on the Discovery Bank app that gives clients an understanding of the behaviours that influence their financial wellbeing, while giving them the tools to improve their financial behaviours. The more clients improve their financial behaviour, the higher their Vitality Money status and the greater the value they receive.