Press release -

New research from Discovery Green and EY highlights the impact of rising carbon taxes on the electricity costs of South African businesses.

Key findings:

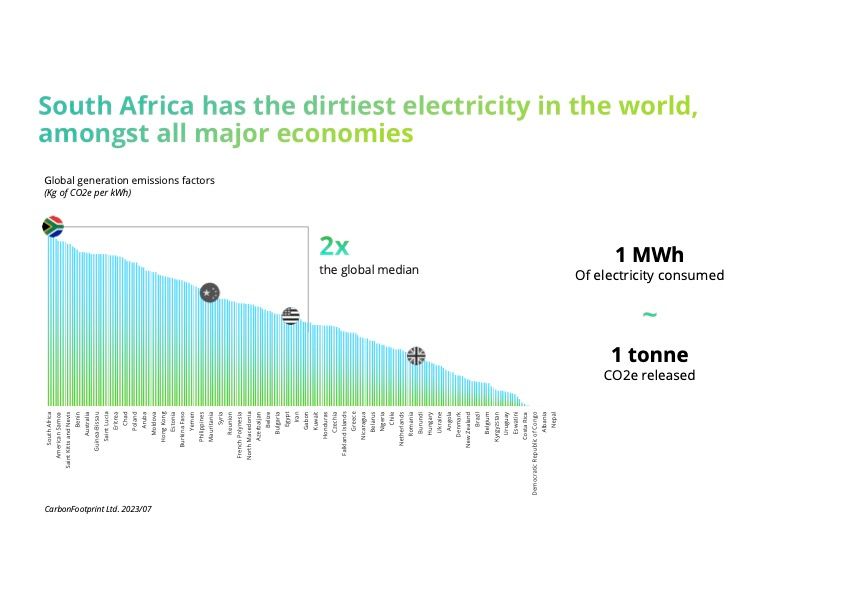

- South Africa’s heavy reliance on coal for electricity generation makes it one of the world’s most carbon-intensive economies, exposing local businesses to significant financial risk from global and local carbon taxes.

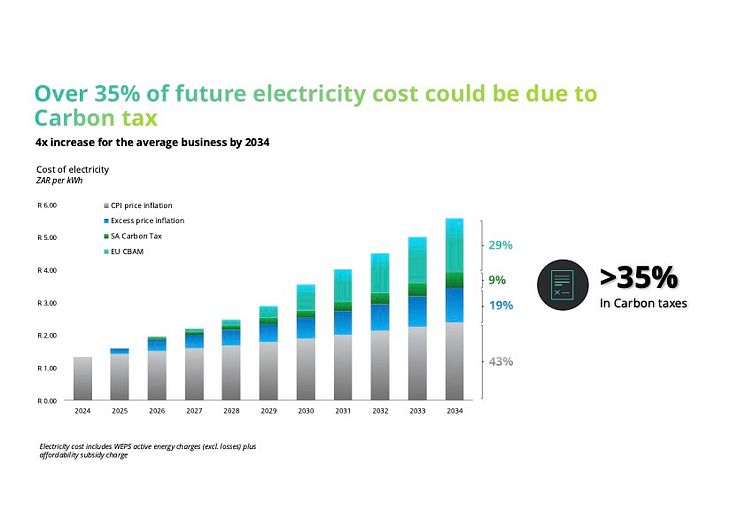

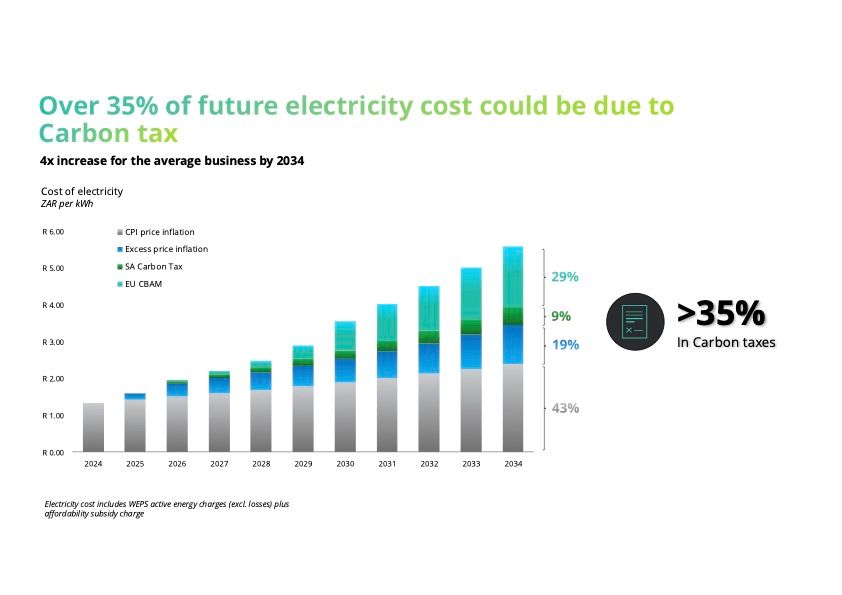

- By 2034, carbon taxes could make up over 35% of electricity generation costs.

- South African businesses face a ‘double whammy’: Local carbon taxes are expected to increase by 143% by 2030. In addition, tax allowances, which give businesses up to 85% relief, could be completely phased out in 10 years.

- From 2026, South African companies exporting to the European Union (EU) could be subject to additional taxes from the EU’s Carbon Border Adjustment Mechanism (CBAM), which could be three times higher than South African taxes by 2030.

- The EU’s Carbon Border Adjustment Mechanism (CBAM) threatens R52.4 billion of South African exports[i].

- Transitioning to high coverage renewable energy is the only sustainable solution for businesses to remain competitive in tomorrow’s low-carbon economy.

By 2034, some South African businesses could be paying an additional 60% of their electricity generation costs in carbon taxes. This is according to new research by Discovery Green, in partnership with EY’s Africa Sustainability Tax division, which highlights the significant financial risk local businesses face. South African carbon taxes alone are projected to increase by 143% by 2030. Tax allowances, which offer up to 85% relief, depending on the industry, may be phased out within the decade.

The core of the problem is South Africa’s heavy reliance on coal for electricity generation, emitting roughly 1 tonne of CO2e for every megawatt-hour of electricity consumed. This makes our electricity twice as carbon intensive as the global median. According to the research findings, this is environmentally unsustainable and financially disastrous when you factor in local and global tax policies.

“In the next ten years, businesses could be paying a 60% carbon tax premium on top of increasing electricity costs, significantly increasing their operating expenses,” says Andre Nepgen, Head of Discovery Green. “The only way to mitigate the financial risk of carbon taxes is to consider high coverage renewable energy strategies that limit the reliance on coal-generated electricity to zero.”

South Africa’s increasing carbon taxes on electricity

For decades, governments worldwide have implemented various carbon control measures. This includes regulation, pricing measures (like taxes or cap-and-trade schemes) and incentives such as subsidies, tax exemptions and loans or cash grants.

“Scope 1 carbon mitigation measures target the direct emissions of a business. Scope 2 measures concentrate on the amount of carbon a business imports, such as the use of fossil fuel-generated electricity, while Scope 3 measures usually include taxing businesses for their supplier’s carbon footprint,” explains EY Tax Partner Duane Newman, a leading expert on African and global carbon tax systems.

The Carbon Tax Act, signed into law in May 2019, introduced a relatively low carbon tax (currently R190 per tonne of carbon emitted), softened by incentives and allowances. Initially, this tax was not passed onto electricity prices, meaning that end users don’t pay for the carbon emissions from electricity consumption.

However, in January 2026, South Africa is expected to enter the second phase of its carbon tax journey. The National Treasury has published the carbon tax rate up until 2030, by which time the cost is estimated to be R462 per tonne of carbon emitted. Importantly for businesses consuming even modest quantities of electricity, Scope 2 emissions on electricity consumption will also be considered. According to Newman, “Individual businesses will be taxed for the carbon footprint associated with the production of any energy they use.”

On top of that, the current sizeable tax allowances are expected to fall away from January 2026 and it is unclear if new incentives or allowances will be introduced. That said, “As in other carbon tax regimes globally, we expect these allowances to be phased out incrementally over time,” adds Newman.

Either way, South African businesses can expect a significant increase in local carbon taxes from 2026. On the current carbon tax regime, this would increase existing electricity generation costs by 4% to 6% in 2026 and by 24% to 34% by 2045. “As allowances are phased out and new taxes kick in, some businesses are likely to see a 340% increase in domestic carbon tax payments on electricity consumption over a five-year period,” warns Nepgen. Current estimates are that by 2050, for example, the country’s carbon tax rate will be around $120 (R2,160) per tonne of carbon emitted.

The impact of EU taxes on South African exporters

From 2026, businesses that export to the European Union (EU) could also have to contend with hefty carbon taxes from the EU’s Carbon Border Adjustment Mechanism (CBAM). CBAM will require South African exporters to pay the difference between South Africa’s relatively lower carbon taxes and Europe’s stricter carbon tax regime, explains Newman.

By 2026, the price of carbon in the EU is expected to reach €85 (R1,630) per tonne of CO2e, compared to South Africa’s expected €5.5 (R105) per tonne, after tax allowances are considered. With the EU being South Africa’s largest trade partner, this significant difference in the price of carbon means that around R52.4 billion in South African exports are at risk in the short term.

According to Discovery Green, the expected carbon tax differential between South Africa and Europe in 2034 means that CBAM could increase electricity generation costs for affected industries by 70% in today’s terms. Energy-intensive industries like aluminium, iron and steel are expected to be particularly hard hit. As the scope of CBAM expands, even more industries and exports could be at risk, Nepgen explains.

“The combination of domestic tax increases and CBAM will have significant cost implications for businesses subject to carbon tax. Our research highlights the urgency with which businesses need to prepare for a future where carbon taxes contribute more than 35% of total electricity generation costs,” says Nepgen.

Act with urgency

Investing in high coverage renewable energy offers more than just a reduction in a company’s carbon footprint. It is essential to safeguard profitability against increasing electricity costs driven by rising carbon taxes. “As carbon tax costs continue to climb, it’s never been more urgent to act,” says Nepgen. “By proactively transitioning to high coverage renewable energy, businesses can mitigate significant new financial risks while contributing to a sustainable future.

“Waiting will result in significant long-term costs and missed opportunities for innovation and growth in a low-carbon economy.”

[i]Maimela S. 2023. Responding to the European Union’s Carbon Border Adjustment Mechanism (CBAM): South Africa’s vulnerability and responses.

Categories

Discovery information

About Discovery Green

Backed by the scale and actuarial expertise of the Discovery Group, Discovery Green empowers businesses to replace 90% of their electricity demand with affordable, price-certain renewable energy from some of the largest wind and solar plants in the country. Visit https://www.discoverygreen.co.za/ for more.

Follow us on Twitter @Discovery_SA