Press release -

Holiday travellers face biggest risk on roads – Discovery Insure

Holiday travellers face biggest risk on roads – Discovery Insure

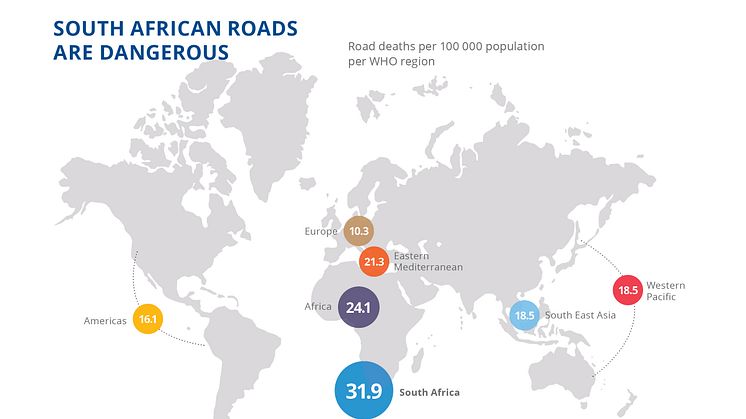

South Africa’s road accident fatality rate, one of the highest in the world, costs the economy between 8% and 10% of GDP. On average, there are over 200 roads deaths over the Easter holiday period every year. Recent research conducted by Discovery Insure analysing driving behaviour reveals that holiday-makers (people who drive long distances to get to their holiday destinations), are more at risk of being involved in an accident.

The research, which compares long distance driving behaviour in holiday seasons during 2014 to out of holiday season driving behaviour, shows that drivers are less patient and in more of a hurry, with speeding increasing by 26% during peak holiday times. The data also shows an increase of 5.5% in late night driving putting drivers at greater risk of being in an accident by as much as 30%.

Responding to these insights into holiday driving behaviour, Discovery Insure Executive Director Anton Ossip said, “Improving driver behaviour is critical to reducing South Africa’s very high road accident and accident fatality rate. In line with our aim to achieve long-term positive behaviour change in driving habits, this latest research provides evidence-based tips for drivers to proactively amend their behaviour behind the wheel. It is about each of us taking responsibility and being proactive in improving the way we drive.”

Discovery Insure’s primary goal is to improve the safety of our roads by encouraging better driving behaviour through increased knowledge and awareness of what makes a good driver. “As we build our understanding of the risks associated with certain behaviours, we’re working to reduce the frequency of accidents and the cost of dealing with them while simultaneously saving lives” added Ossip.

Unsafe driving: Not worth it

Another element of the research conducted focused on determining the risks versus the benefits of speeding and not stopping for breaks during a long journey. The analysis revealed that driving from Johannesburg to Durban (565km) will take about 5.5 hours if you drive within the speed limit and stop every two hours for at least 15 minutes. Driving faster than the speed limit and not stopping will get you in Durban an hour faster, but will double your risk of being in an accident, without factoring in the effects of driver fatigue. This analysis clearly indicates that the risks of driving unsafely during long journeys outweigh the benefits of getting there faster by a significant margin.

Minister of Transport Hon. Dipuo Peters said, “We encourage motorists to take the necessary precautions and use the information on driving trends at their disposal to improve their driving behaviour and to ensure that they safely reach their destinations over the upcoming Easter weekend.”

“The Department of Transport supports initiatives by private sector companies that are aimed at improving road safety. It’s through multi-stakeholder participation that we can successfully reduce the alarming road fatalities rate and ensure safer roads” concluded Minister, Peters.

Unsafe driving: Not worth it

- Avoid leaving on a Friday as the roads are 15% busier, with worse driving. People drive worse on a Friday with increases of between 15-20% in harsh acceleration, braking, and cornering events, as well as speeding.

- Drive better by accelerating, braking, and cornering smoothly, driving within the speed limit, and reducing late night driving (between 10pm and 4am). Improving these driving behaviours reduces the risk of having

- an accident by more than half.

- Completing a vehicle safety check before leaving reduces your risk of having an accident by 15%.

- Avoid driving at night (between 10pm and 4am) – the chances of being in an accident late at night are 10 times higher than any other time of day.

According to Ossip, “Road accident claims from Discovery Insure members show that they experience a 2/3rds lower fatality rate in vehicle accidents compared to the national average. On a broader canvas,there is a 34% lower claim rate among drivers who are rated good or excellent compared to drivers who are rated poor or average.”

As a means to encourage safer driving especially during high risk periods, Discovery Insure members driving more than 300km between the 25 March and 4 May who break for at least 15 minutes every two hours and avoid travelling late at night will increase their fuel rewards by 25%.

Topics

Categories

Discovery information

About Discovery Limited

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment products and wellness markets. Founded in 1992 by the current Group Chief Executive Officer Adrian Gore, Discovery was guided by a clear core purpose – to make people healthier and to enhance and protect their lives. Underpinning this core purpose is the belief that through innovation Discovery can be a powerful market disruptor.

The company, with headquarters in Johannesburg, South Africa, has expanded its operations globally and currently serves over seven million clients across South Africa, the United Kingdom, the United States, China and Singapore. Vitality, Discovery’s wellness programme, is the world’s largest scientific, incentive-based wellness solution for individuals and corporates. The global Vitality membership base now exceeds 5.5 million lives in five markets.

Discovery is an authorised financial services provider. It trades on the Johannesburg Securities Exchange under the code “DSY”.

Follow us on Twitter @Discovery_SA