Press release -

Financial institutions and financial planning industry must embrace change and innovate to grow

Sizwe Nxasana comments on the need for financial institutions to harness digital opportunities

JOHANNESBURG, May 19, 2015

South Africa’s financial institutions and financial planning intermediaries will have to continue embracing change, innovation and technology if they are to grow in an environment where the direct distribution model is the fastest growing channel in the R6 trillion savings and investment sector.

This is the view of Sizwe Nxasana, outgoing CEO of financial services giant, FirstRand, who was a keynote speaker at the second Annual Discovery Financial Planning Summit held in Sandton on Tuesday, attended by over 1 000 delegates. “This year the aim is to give financial advisers knowledge and access to local and global thought leaders to provide better financial advice to consumers of financial services”, said Hylton Kallner, Chief Marketing Officer at Discovery when he opened this year’s Summit.

Splitting the savings and investment sector into institutional (around R3.2 trillion) and retail (around R2.8 trillion), Nxasana said the retail sector is where the main growth is taking place with direct distribution growing at about 30% a year.

“We need to change the way we interact with our customers, improve the quality of advice, leverage technology and better serve the needs of customers,” he said, stressing the growing trend of disintermediation of banks and insurance companies and giving examples of several entrepreneurial players who are each getting strong traction, especially in East Africa.

“In the six years since the global financial crisis, we have seen massive change, with the credibility of banks and insurance companies being called into question. This has led to an explosion of new players in this space.”

According to Nxasana, smartphones have democratised access to financial services and social media platforms are now a major force in the financial services space. He said it is “a challenge” for big companies in the financial services arena, “who are sitting with legacy systems”, to adapt to new ways of doing things.

Focusing on the advent of big data, Nxasana said this has made it easier for customers, sellers of information and competitors to set up businesses. New players, who provide direct services to customers, have also made it easier for customers to provide information, taking advantage of the perception that traditional banks and insurance companies are too slow and cumbersome.

“Technology and the digital age create opportunities to meet the needs of customers and it is essential that players in the financial services realise this and adapt to these changes,” he said.

ENDS

Notes to editors:

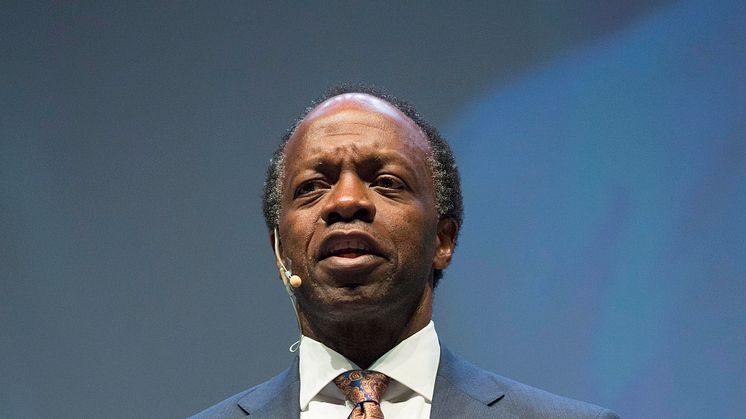

Attached: Sizwe Nxasana speaking at the Discovery Financial Planning Summit 2015

For media queries contact Felicity Hudson on 071 680 0234 or felicityh@discovery.co.za.

For updates throughout the day follow Discovery_SA on Twitter and track #DiscoveryFPS15.

Topics

Categories

Discovery information

About Discovery Limited

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment products and wellness markets. Founded in 1992 by the current Group Chief Executive Officer Adrian Gore, Discovery was guided by a clear core purpose – to make people healthier and to enhance and protect their lives. Underpinning this core purpose is the belief that through innovation Discovery can be a powerful market disruptor.

The company, with headquarters in Johannesburg, South Africa, has expanded its operations globally and currently serves over seven million clients across South Africa, the United Kingdom, the United States, China and Singapore. Vitality, Discovery’s wellness programme, is the world’s largest scientific, incentive-based wellness solution for individuals and corporates. The global Vitality membership base now exceeds 5.5 million lives in five markets.

Discovery is an authorised financial services provider. It trades on the Johannesburg Securities Exchange under the code “DSY”.

Follow us on Twitter @Discovery_SA