Press release -

Discovery posts strong operating full-year results in challenging macro-economic environment

Discovery reported its’ full-year results for the period ended 30 June 2022 today.

Highlights:

- The strong operational performance of all three main business areas, the SA composite, the UK composite and Vitality Global demonstrates the relevance of the Vitality Shared-value business model and the value it delivers to clients and broader society

- New business initiatives grew strongly, led by the Bank and initiatives within Vitality Group, notably Amplify Health – positioning the Group well to revert to its long-term guidance of 10% of operating profit

- Profit for the year increased by 70% to R5 479 million

- Core new business annualised premium income (API) increased 6% to R21 710 million

- Normalised operating profit increased by 45% to R9 384 million

- Normalised headline earnings increased by 71% to R5 816 million

- Basic headline earnings per share (HEPS) increased by 74% to 792.4 cents

7 September 2022 – Discovery’s Group Chief Executive, Adrian Gore, today shared the Group’s full-year results for the period ended 30 June 2022 with the investor community. The Group posted a positive operating performance from its established businesses despite a complex operating environment during the past year as conditions in terms of COVID-19 started to normalise in most markets, excluding Asia, which was greatly affected by several strict lockdowns and restrictions.

Gore commented, “Despite very volatile political and economic markets, the Group has made excellent progress on its growth strategy, as evidenced by Discovery Bank and the evolution of our global healthcare model, mainly through Amplify Health, our recently-announced partnership with AIA in Asia.”

Gore summarised the focus areas for Discovery as the Group continued its strategy to achieve growth, following a cycle of intense organic investment into new initiatives, including Discovery Bank, Vitality Health International, and V1, the platform to scale the globalisation of Discovery’s Shared-value model:

- Competitive positioning of businesses within South Africa and the UK, as well as Vitality Global, through the successful navigation of COVID-19, investment in the Vitality Shared-value model and ensuring excellent operational delivery.

- Driving new initiatives to scale, led by Discovery Bank and Vitality Group, and streamlining certain initiatives to position Discovery well for future growth.

- Ensuring capital and business discipline with high levels of liquidity and solvency.

Commenting on the Group’s ability to attract new business, Gore said, “Discovery’s core new business annualised premium income (API) increased by 6% to R21 710 million, driven in particular by strong growth from the SA and UK Composites. Discovery Bank performed exceptionally well, growing its client base to over one million accounts, retail deposits by 30% to R10.6 billion and advances by 14% to R4.3 billion.”

Discovery’s South African group of businesses performed remarkably well, with a strong recovery from Discovery Life and solid performances from Discovery Health and Discovery Invest. Normalised operating profit increased by 41% to R8 679 million and new business by 15% to R14 257 million, excluding new initiatives. During the period, Discovery Insure was negatively impacted by severe weather events in KZN and an increase in power surge-related claims, combined with considerable supply-side inflation in motor vehicle repairs and parts.

In the UK, normalised operating increased by 28% to £98.7 million (R1 999 million, up 25%) and new business by 22% to £148 million (R2 994 million, up 19%), excluding new initiatives. In China, Ping An Health Insurance is delivering faster premium growth than the overall industry, with the business reaching considerable scale. Ping An Health today insures over 28 million lives.

On Discovery’s global expansion, Gore said, “There has been significant investment within new initiatives in Vitality Health International, with a focus on expanding the Group’s global health solutions business and maintaining global leadership in behaviourally led solutions. The largest investment over the period was in the Amplify Health joint venture with AIA, offering digital health solutions across Asia-Pacific. The business also launched Shared-value health insurance products, which incorporate Vitality, to employer groups operating in multiple African countries beyond South Africa.”

During the period, Discovery made a strategic decision to streamline certain initiatives to improve long-term value. “In addition to reviewing our stake in AIA Health in Australia, we decided to exit the UK investment market given the structural change in market conditions, mainly driven by significant margin compression. Despite VitalityInvest making good progress over the period, the decision was taken based on the time and resources needed to accumulate the necessary assets under management for the business to turn to profitability and to generate material long-term value for the Group.”

A key characteristic of the reporting period was Discovery’s continued resilience during the COVID-19 period, enabled by its business and capital strength. Liquidity and solvency remained robust across the Group, despite paying R3.7 billion in COVID-19 claims in the reporting period in SA, gross of reinsurance. Gore commented, “Discovery’s business model has proven to be highly relevant during the COVID-19 pandemic, with robust underlying growth trends continuing in most parts of the business. We will continue to capitalise on growth opportunities while ensuringoperational resilience.”

ENDS

Notes to the editor:

The SA and UK Composites delivered strong growth in normalised operating profit and new business, while the operating performance of Vitality Global reflected the specific dynamics of the impact of COVID-19 on the Asian markets.

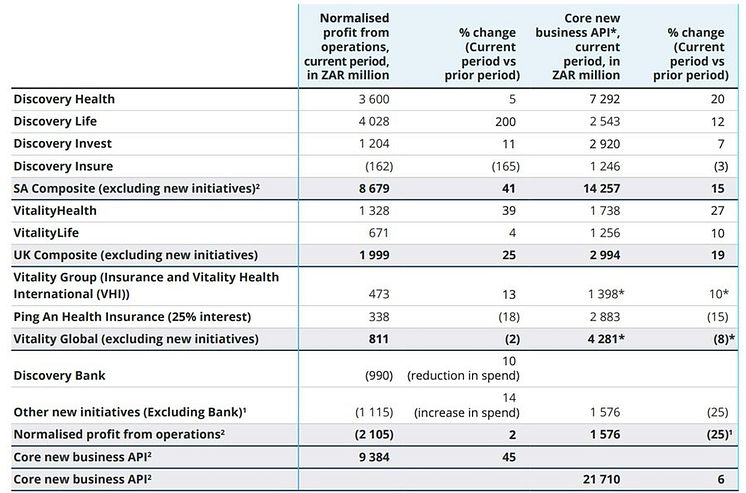

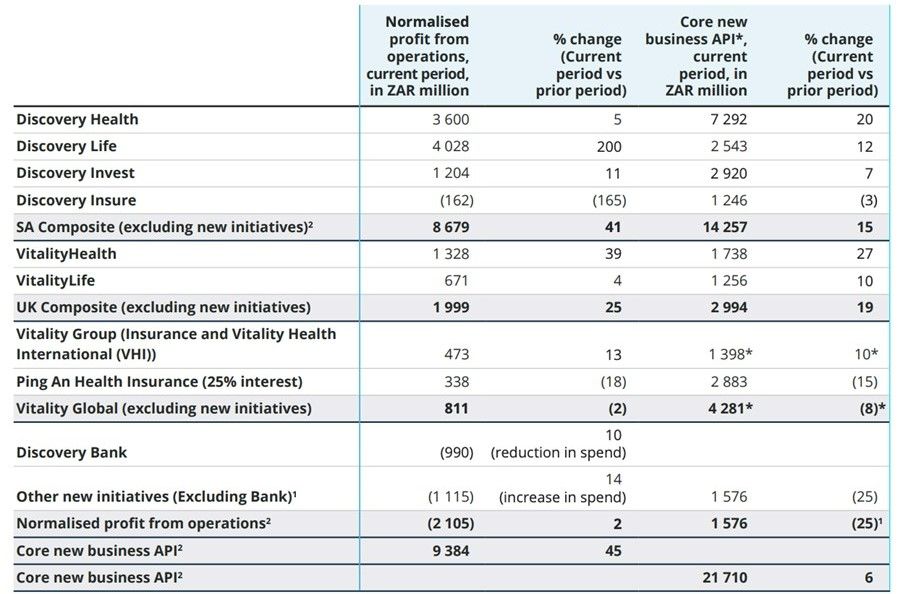

The following table provides a summary of the performance:

* Core new business API excludes DH take-on of new closed schemes and gross revenue for Vitality Group

1. Refer to normalised profit from operations regional disclosure for regional composition of new initiative spend; Core API for other new initiatives includes Umbrella Funds, Discovery Insure commercial and VitalityInvest – new business was impacted by the lumpy nature of Umbrella Fund sales which grew strongly in the prior period

2. Includes SA Vitality:normalised profit from operations includes R9 million (prior period: R43 million); core new business API includes R256 million (prior period: R24 million)

Topics

Categories

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, banking, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in over 35 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA