Press release -

Discovery Life reaches R5 billion in PayBacks to clients, over and above claims paid of R26.5 billion

By simply linking a Discovery Life Plan with other Discovery products, such as Vitality, Vitality Active Rewards, a health plan administered by Discovery Health and now a qualifying Discovery Bank account, clients can be rewarded for their entire policy term with upfront and ongoing premium discounts and PayBacks of up to 42% and 50%, respectively. In addition, clients can receive automatic cash payouts in retirement for managing their health and wellness.

“Discovery Life offers value for money to our clients as a life insurance product that helps you live longer, healthier and with greater prosperity,” says Discovery Life Head of R&D, Gareth Friedlander.

Discovery Life has long been a pioneer in the life insurance industry, with products that ensure clients are protected in the case of death, disability or severe illness. Since launching in 2000, Discovery Life has offered clients considerable value for money through the PayBack benefit, amongst others. These clients have cumulatively been rewarded with R5 billion in PayBacks this October.

“Discovery Life has for many years used dynamic underwriting and wellness measures to determine client risk and premiums to benefit clients. Whereas life assurers traditionally only apply underwriting on static information such as age, gender and smoking status, Discovery Life has the ability to measure, track and encourage healthy behaviours over the long term through its integrated model with the Vitality wellness programme,” says Andrew Mc Currie, Discovery Life’s Head of Technical Marketing.

“The more clients engage with Vitality to improve their health, the less they claim. This is evidenced in Discovery's Diamond Vitality status policyholders who have a 75% lower mortality risk compared to the industry average, as a result of leading a healthy lifestyle,” adds Mc Currie.

“Discovery Life shares this saving with our clients by paying up to 50% of their premiums back to them through PayBacks. This is true shared value, as society benefits from healthier people and improved productivity.”

Discovery has also paid over R26.5 billion in life insurance claims to date, thanks to its innovative, objective and proactive claims assessment criteria. Discovery Life is the only insurance company which helps its clients by proactively identifying claims through its uniquely integrated insurance products.

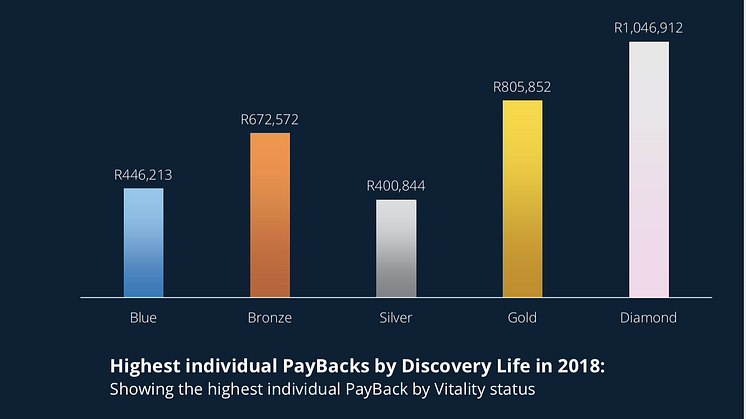

While it is true that the healthier you are, the more you can earn in PayBacks, all clients can gain significant value regardless of their Vitality status.

Clients of Discovery Life can now also calculate how much they could get back and how they can get even more of their premiums back with Discovery Life’s PayBack calculator.

PayBacks embody shared value for clients

“We are confident that Discovery Life provides the best value in the market to those who actively engage with Vitality,” adds Friedlander.

“The total amount paid to healthy clients through our unique shared value insurance model is currently 25% of what’s paid through claims on adverse events – proof that we give our clients so much more than innovative products and honoured claims.

“We expect this number to increase markedly in the coming years. These products are at the heart of our model of incentivising our clients to be healthier, and as a result more prosperous,” says Friedlander.

ENDS

Note to editors:

For media queries, please contact Shanti Aboobaker: ShantiA@discovery.co.za

For more about PayBacks see Gauteng financial adviser, Warren Heroldt’s story and client, Manny de Moura’s views about how Discovery Life’s integrated benefits make great financial sense here.

Topics

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness markets. Since inception, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, exported to over 19 countries and reaching over 11 million members. Discovery trades on the Johannesburg Securities Exchange, with a market cap of $7 billion.

Follow us on Twitter @Discovery_SA