Press release -

Discovery Life pays 11.5 billion to clients in 2024

Key insights about Discovery Life’s 2024 Claims Experience include:

- Growth in payments for living benefits – namely illness, disability and income protection – and Shared-value rewards for health behaviours outpaces growth in payouts for death benefits.

- Discovery Life clients who reached a Gold or Diamond Vitality status experienced a 57% lower mortality risk and a 47% lower disability risk, creating value which is channelled back to Discovery Life clients through Shared-value rewards.

- As in past years, over 99% of claims were paid out in 2024. Non-disclosure, misrepresentation and fraud caused less than 1% of claims to be denied.

- Cancer was the highest cause of death for women, the most common severe illness for both women and men, and the most common cause of disability among both women and men.

- Positive cancer-screening trends are resulting in early detection of cancer.

Johannesburg, April 10, 2025 – Discovery Life has published its 2024 claims experience report, revealing a total of R11.5 billion paid to clients during the year. This comprised R6.85 billion in individual life insurance claims, R2.4 billion in Shared-value payments (rewards for healthy behaviours) and R2.3 billion in Group Risk claims.

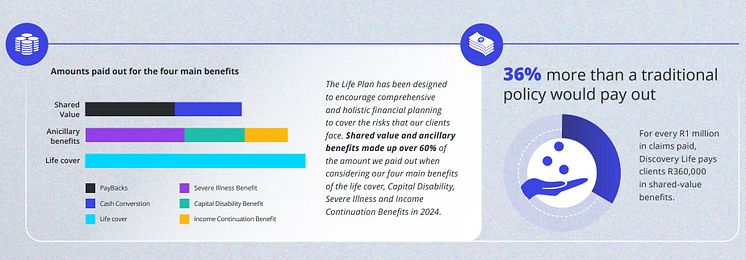

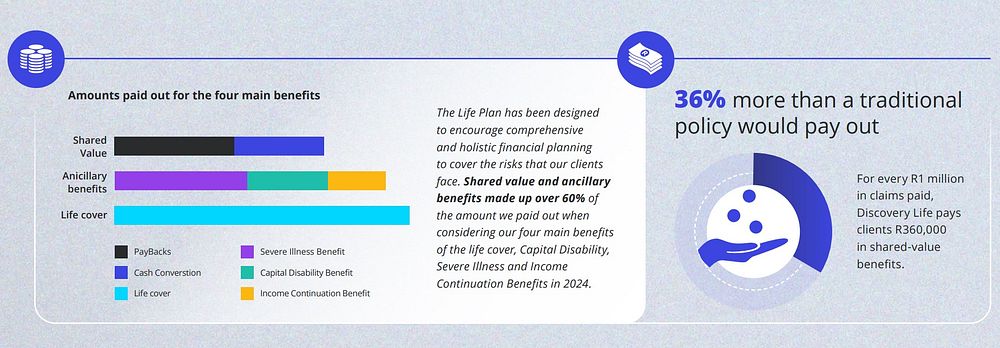

The R6.85 billion paid to individual life insurance clients is made up of:

- Life cover claims: R3.4 billion.

- Living benefit claims: R1.5 billion for the Severe Illness Benefit; R933 million for the Capital Disability Benefit; and R673 million for the Income Continuation Benefit.

- Additional benefits: over R260 million for the Global Education Protector, Funeral policies and other benefits.

Discovery Life’s Head of Claims Sylvia Steyn explains, “In 2024, we paid 99.3% of all claims. Within the remaining 0.7%, 0.4% of claims were repudiated for non-disclosure, 0.2% for misrepresentation, and 0.1% for fraud. This entrenches our track record of paying claims and supporting our clients when they most need their cover.”

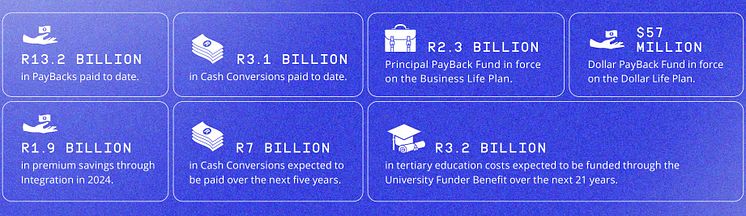

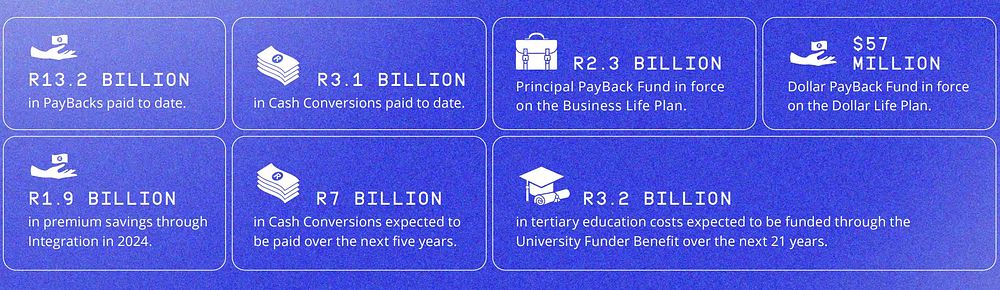

Discovery Life also paid R2.4 billion in Shared-value benefits, comprising R1.4 billion in PayBacks, and R1 billion in Cash Conversions. These are financial rewards based on how well clients managed their health and finances.

“I’m proud to say that 2024 was the first time Cash Conversion payouts reached the one-billion mark in a single year,” highlights Discovery Life Deputy CEO Gareth Friedlander.

“This is powered by clients’ engagement in Vitality – Discovery’s behaviour-based programme that incentivises healthy living. Our latest claims experience also revealed that clients who reached a Gold or Diamond status experienced a 57% lower mortality risk and a 47% lower disability risk, compared to clients who were not part of or did not engage in Vitality. This lowered risk creates previously untapped value that we can return to clients to incentivise them to engage in healthy behaviours.”

Majority of payouts are to clients who are still alive

The payouts outlined above mean that Discovery Life pays more through living benefits (R3.1 billion) and Shared-value rewards (R2.4 billion) than for mortality claims (R3.4 billion). “By comparison, the industry pays about 20-30% in living benefits, while Discovery Life is paying out over 60% to clients who are still alive,” adds Friedlander.

Cancer dominates, but increase in screening rates impacts early-stage claims trajectory

The 2024 claims data shows that cancer was the highest cause of death for women (35%). It was also the most common severe illness for both women and men (51% and 37% respectively), and the most common cause of disability among both women and men (34% and 30% respectively).

The Discovery Group invests significantly in encouraging and supporting clients to carry out regular health screening. Compared to 2020, the 2024 data shows significant increases in screening for common cancers, with mammograms up 14%, colorectal cancer screening 29% higher and 19% more prostate exams, all of which are hitting all-time highs.

Thanks to the increase in screening rates, there has been a 62% increase in early-stage cancer claims compared to 2020’s claims on illness cover. “As a proportion of all cancer claims, lower severity claims continue to have an upward trajectory, showing that these cancers continue to be detected earlier. While Stage 3 and 4 cancers have remained relatively stable over that time, it’s in the disability claims for Stage 4 cancers where we’re seeing incredible benefits of screening, with those claims dropping 16% since last year,” says Dr Maritha van der Walt, Chief Medical Officer for Discovery Life.

Early detection remains key to better outcomes. Data from the Discovery Vitality HealthyFutures model and the US-based Surveillance, Epidemiology, and End Results Program (known as SEER), show that, on average, someone diagnosed with early-stage breast cancer can expect a 96% five-year survival rate. SEER also found that men who are diagnosed with localised prostate cancer have a 99% five-year survival rate.

One in five deaths due to unnatural causes

Cancer and heart and artery conditions were prominent in life cover claims for older age groups. However, looking at causes of death across all age groups, the 2024 data shows deaths occurred for a number of reasons.

One in five death claims were due to unnatural causes, with the largest component attributed to suicide at a staggering 35%, followed by motor vehicle accidents at 23%.

The high proportion of unnatural deaths highlights the need for comprehensive life cover for everyone, irrespective of underlying health status or age. “The data also emphasise the importance of taking mental health concerns seriously, as well as fostering a culture of better driving on South African roads. I’d like to add that the Discovery Health Medical Scheme’s Mental Health Care Programme and Discovery Insure’s Vitality Drive programme actively help to address these issues, respectively,” points out Van der Walt.

Importance of severe illness cover for subsequent claims and at older ages

In 2024, Discovery Life paid out a total of R1.54 billion for 2,900 severe illness claims. Of this, R275 million was paid out in second or subsequent claims, with nearly one in three making their third or subsequent illness claim, and some having claimed over 10 times.

Additionally, Discovery Life paid out R128 million in Converted Severe Illness claims - where a client’s disability cover expires and automatically converts to illness cover. “Illness cover and features like our automatic disability benefit conversion are crucial to ensuring clients have illness protection at older ages. This is very relevant, considering that 28% of severe illness claims are made by clients over 60. Ten years ago, this age group accounted for 11% of our illness claims and five years ago it was 20%.

“While it is natural for claims attributable to this age group to increase as our clients get older, this trend is increasing faster than we’d expect and shows the importance of illness protection at older ages – cover that isn’t always accessible or financially viable at those ages, so it is crucial to get this form of cover when you’re young,” notes Friedlander.

Offshore protection in US Dollars offers clients and their families greater financial security through uncertain economic conditions

Recent geopolitical volatility has highlighted the value of offshore risk protection in diversifying clients’ cover - similar to how they might diversify their investments. This approach can provide a hedge against external events that affect exchange rates and also protect against potential future costs and liabilities that move in line with global markets.

Discovery Life’s Dollar Life Plan pays out claims in US dollars, to provide this sort of risk cover diversification. Since 2014, it has paid out over $34 million in claims, with these payouts worth an extra 19% as they are denominated in US dollars.

ENDS

Topics

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, banking, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in over 40 markets with over 40 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA