Press release -

Discovery Life continues to have a positive impact on clients, with over R11.7 billion claims paid in 2021

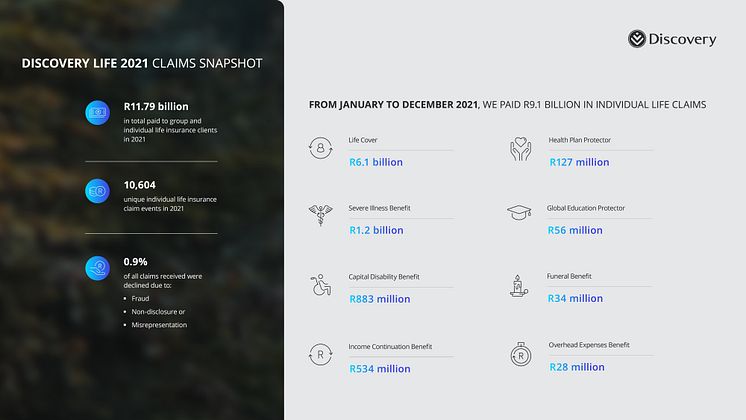

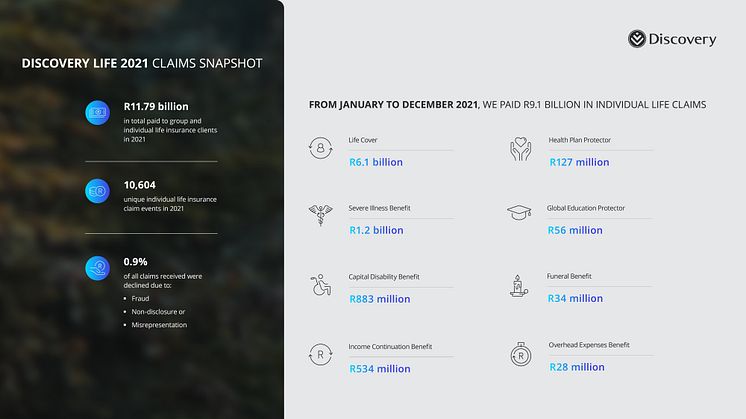

Johannesburg – A total of R11.79 billion was paid out in claims by Discovery Life in the 2021 calendar year including individual and Group Life clients, as released this morning in the annual claims review. A total of R9.1 billion was paid through over 10,000 Individual Life claims during the year. COVID-19 claims on both Group and Individual Life policies over 2020 and 2021 total R6.5 billion, with R3.8 billion having been paid in 2021 alone on Individual life policies. Uniquely, Discovery Life also returned R1.3 billion in 2021 to clients in the form of PayBacks for making healthy lifestyle choices, bringing the total amount paid in PayBack till 2021, to R9.1 billion.

Notable points:

- COVID-19 accounted for 60% of the value of death claims in 2021 making it the single highest cause of death in any given year since 2012. Put differently, COVID-19 almost tripled the Rand amount of death claims during 2021 compared to pre-pandemic levels.

- R64 million worth of income was paid out under the Income Continuation Benefit in relation to COVID-19.

- Over R4.5 million was paid in 2021 to cover education costs of children due to their parents passing on or being severely ill from COVID-19

- Only one COVID-19 death has been recorded amongst Gold and Diamond Vitality status clients who are fully vaccinated demonstrating the combined positive impact of healthy living and vaccination.

- At least 75% of Discovery Life clients are vaccinated against COVID-19 compared to the national rate of 32%. Discovery Life has not received a single claim as a result of a vaccination side effect

“Our 2021 claims data shows how we continue to live out our core purpose of making people healthier and enhancing and protecting their lives,” said Riaan van Reenen CEO of Discovery Life. “The volume and wide variety of claims as well as value returned to clients for healthy behaviour reveals an all-round positive impact on the lives of clients. Unlike any other insurer, we proactively contacted clients to make them aware of a valid claimable event through our Proactive Claims Feature, that is built into all policies. This feature is enabled through integration with Discovery Health, and is particularly relevant in the case of less severe health events, where clients may not be aware that they qualify for a valid life insurance claim,” he added.

The tangible positive impact of Discovery Life’s comprehensive insurance offering on our clients is further demonstrated through the comprehensive support for children who have tragically lost their parents or who themselves have experienced a life-changing event.

Funding for the education of children whose parents have suffered life changing events

Through Individual and Group Life benefits combined, nearly 1,900 children’s education costs are currently being funded through the Global Education Protector. 2021 saw R56 million paid to cover the education costs of children due to a parent or guardian suffering an adverse life event. Currently over 36,000 children are covered on Individual life policies through this benefit. The unique University Funder Benefit, which channels surplus created through healthy behaviour of parents to fund up to 100% of their children’s university education costs, is projected to provide R3.4bn in funding for tertiary education of these children over time. This is yet another example of how Discovery Life is enabling our clients to monetise and derive value from looking after their health and wellbeing.

Cover for children experiencing a life-changing event

In this last year, Discovery Life paid 122 claims for child severe illnesses for the children of clients with our market-leading Severe Illness Benefit. This speaks to the relevance of bespoke insurance cover for children, which Discovery Life provides through the Child Protector Benefit, which provides cover from birth and pays 100% on all childhood cancers.

Discovery Life clients enjoy peace of mind through our Income Continuation Benefit

Discovery Life paid R534m to 2985 claimants in 2021 for the Income Continuation Benefit, and expects to pay a further R2.5bn to current claimants in the future. More than 1300 of these claims were for COVID-19. Excluding Healthcare professionals on the frontline, there was more than a 500% increase from 2020 in ICB-claims amounts for other professionals in 2021 as more variants emerged.

Routine, proactive cancer screening saves lives

Icon, the Independent Clinical Oncology Network of South Africa, has rated Discovery Life’s Lifetime Severe Illness Benefit as the number one insurance benefit for cancer protection in the market. Cancer is now the leading cause of severe illness for men and women, accounting for half of all Severe Illness Benefit-claims by women, and a third of all claims by men. Breast cancer and prostate cancer remain the most prevalent amongst our clients claiming for cancer.

Discovery Life Deputy CEO, Gareth Friedlander, commented on the concerning trend in mental health conditions: “Our claims data shows that mental health concerns are not specific to any one age group. In 2021 alone Discovery Life recorded an 18% increase in the number of suicides year-on-year, with R405 million paid in claims related to mental and behavioural conditions and suicides. In the last four years, our data shows that the number of suicides is more than 25% percent higher than in the four years before that.”

Friedlander also revealed data evidencing that healthier living, through increased engagement with Vitality, does lead to a general drop in morbidity and mortality. “In 2021, Gold and Diamond Vitality members experienced 59% lower mortality risk compared to clients who did not engage with Vitality. Vitality-engaged Discovery Life clients experienced 37% lower disability rates, showing that positive behaviour change is vital in mitigating health risks. Engagement in health and wellness has also reduced the risk of death from COVID-19 for our Diamond Vitality status clients by as much as 85%.

In 2021, Discovery Life became the first life insurer globally to reward clients for being vaccinated against COVID-19, dovetailing Discovery’s leading position as the single largest private sector contributor to South Africa’s national vaccination drive. To incentivise vaccination during the COVID-19 pandemic, new clients were guaranteed their maximum PayBack in the first year of their policy through the Vaccination Max PayBack limited offer. This initiative has been nominated for a global Innovation in Insurance award by Efma and Accenture. The vaccination drive has yielded extremely positive results. 75% of Discovery Life’s book is at least partially vaccinated against COVID-19.

The record levels of claims payments to clients during 2021 demonstrates the immense value that Discovery Life’s disability, severe illness and life insurance adds to families, businesses and society.

“The longer-term impact of COVID-19 remains uncertain, and we urge everyone to make sure that they have sufficient cover to protect against unexpected life changing events. Life insurance has seldom been more valuable than at present,” concludes van Reenen.

Note to editors:

PayBacks: Over the years, we have gathered an in-depth understanding of the impact that health and wellness have on insurance risk. The PayBack benefit is a benefit of the Discovery Life shared-value model, whereby up to 100% of your life insurance premiums are paid back to you at set periods of time depending on various factors for example engagement in the Vitality programme. This return of premium is as a result of reduced health risks through healthier life choices.

The University Funder Benefit: Over the years, we have gathered an in-depth understanding of the impact that health and wellness have on insurance risk. Based on our knowledge of these relationships, we are able to reward your improved health and wellness with a financial asset that can help fund your children’s tertiary tuition fees through the University Funder Benefit. If you actively manage your health and wellness, we will fund up to 100% of your child’s tertiary tuition, not because you have claimed for a health event, but because you have made healthy life choices.

The Efma-Accenture Innovation in Insurance Awards: Accenture and Efma, a global non-profit organization that facilitates networking between decision-makers in banking and insurance, jointly launched the Innovation in Insurance Awards in 2016.

Topics

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in 27 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA