Press release -

Discovery Life clients receive R11bn in 2022 through claims and Shared-value pay-outs

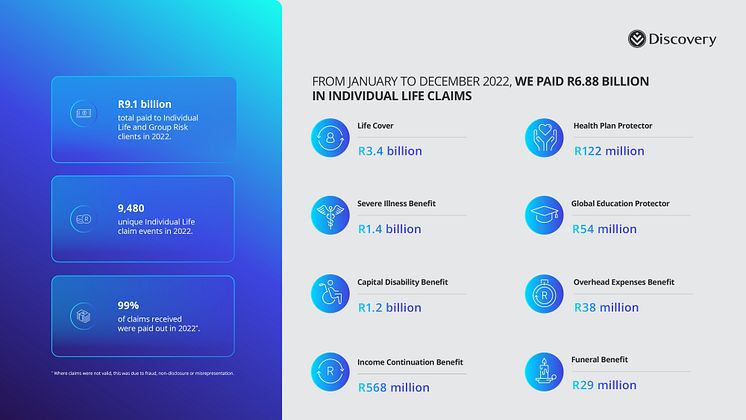

Johannesburg– Discovery Life’s annual claims review reveals a total of R11 billion was returned to its clients in 2022 in claims linked to uncertain, life-altering events and shared-value benefits. These pay-outs comprised of R9.1 billion in individual life and group life claims and R1.9 billion in PayBack and Cash Conversion payments to clients for managing their health and wellness.

While COVID-19 is no longer a global health emergency, the residual effect of the pandemic is evident in the increased claims for living benefits such as Severe Illness, Capital Disability, and Income Protection compared to the previous year.

Discovery Life Deputy Chief Executive, Gareth Friedlander explains: “Despite the total value of claims reducing from R11.79 billion (2021) to R9.1 billion, as a result of fewer COVID-19-related death claims, Severe Illness pay-outs rose by 16%, Disability by 38% and Income Protection by 6%. The reduction in COVID-19-related death claims was offset by increasing morbidity trends, reflecting the changing nature of risk related to COVID-19 as it shifts from pandemic to endemic state.”

Discovery Life clients continued to experience the impact of COVID-19 in a post-pandemic world.

Discovery Life’s data supports the evidence that COVID-19 is demonstrating significantly lower mortality risk, but the longer-term impact of the illness and the pandemic are expected to persist, with research from the Economist suggesting that global mortality remains elevated by 5% when compared to pre-pandemic levels.

During 2022, Discovery Life paid out a total of R626 million for COVID-19-related individual life claims. “The impact of the pandemic on clients has shifted.” Friedlander explains, “We are now processing more claims for living benefits than for life cover. Long-COVID isn’t entirely understood but the risk is expected to continue for the foreseeable future and presents another reason for South Africans to ensure that they have sufficient long-term risk cover in place.”

“Another side effect of the pandemic is the considerable decrease in health screening,” says Friedlander. Distinct parallels can be drawn between Discovery’s observed health screening deficit and a higher severity diagnosis in severe illness claims. “Cancer has always been high on the list of reasons for severe illness claims. Now, after the reduction in screening during the pandemic, we’re seeing the impact of late-stage diagnoses,” explains Discovery Life Chief Medical Officer, Dr Maritha Van Der Walt.

“This serves as a stark reminder for us all to maintain our health through annual routine check-ups. Early detection of most health conditions, especially severe illnesses like cancer, remains critical for reducing risk and improving outcomes,” Van Der Walt adds.

“As much as 47% of our severe illness cancer claims are for those where health check screenings are already an established practice at a population level. Regular screenings are crucial for improving breast, prostate, cervical and colon cancer survival rates, where early detection is possible and could vastly improve the health outcomes of clients.”

“For instance, early-stage-diagnosed breast cancer has a 95% survival rate, and similarly, early-stage prostate cancer has a 99% survival rate. At late stages, both conditions have a 30% and 31% survival rate, respectively,” shares Van Der Walt.

The 2022 claims experience also reveals an increase in claims related to unnatural causes.

“As we move beyond the pandemic people are starting to really live their lives again and move back into pre COVID-19 kinds of activity,” says Friedlander. Discovery’s own data from across the group supports this. Physical activity has encouragingly leapt by 67% since 2020 according to Vitality data. Discovery Bank spend trends data shows increased travel more than pre-COVID-19 levels, partly driven by the cost of travel.

“Our shared data with the Discovery Insure and Vitality Drive, reveals that our clients’ driving has recovered to just shy of pre-pandemic levels - but slightly lower as people drive less to work to adapt to hybrid working. Unfortunately, life claims due to unnatural conditions have also increased with the return of pre-pandemic behaviours,” says Friedlander.

The report reveals that the full spectrum of unnatural death claims is broken down as 30% motor vehicle accidents, 30% other accidents, 24% suicide, and 16% due to crime events.

There was a temporary reduction in motor vehicle fatalities due to reduced driving activity during COVID-19 lockdown periods. However, during this endemic period, death claims due to motor vehicle accidents and as a percentage of death claims have increased by as much as 18% between 2020 and 2022. “Positively though, Discovery Insure’s Vitality Drive model is demonstrating significant behaviour change with pleasing outcomes – no Diamond status clients were among the driver fatality claims experienced,” Friedlander explains.

Also worth noting is the high impact of motor vehicle accidents on death claims for younger clients. “For clients aged 30 and under, 31% of death claims were for motor vehicle accidents, once again demonstrating the importance of responsible driving behaviour as well as having sufficient risk protection from an early age.”

Mental health concerns

Mental health issues are another worrying trend. Based on research by the South African Depression and Anxiety Group (SADAG) and University of Witwatersrand, it’s estimated that 5.5 million more South Africans are dealing with symptoms of probable depression since pre-pandemic days in 2019. The World Health Organisation estimate that there was a 25% increase in anxiety and depression disorders during the pandemic which shows the impacts on a global scale too.

“A concerning factor is how this impacts life expectancy. Such conditions can reduce longevity by 7.9 years when compared to those individuals not battling such mental health challenges. During the last 10 years, we have paid out more than R3.2 billion for mental and behavioural claims, including suicides. In 2022, Discovery Life experienced suicide claims that were 13% higher than the 2019 – 2021 period and 24% higher than the 2016 - 2018 period. Sadly, suicide claims have also risen amongst younger age groups. We’ve also noted that females are 1.8 times more likely to claim under their income protection benefits due to mental health than males. Males, on the other hand, are 2.2 times more likely to die by suicide than females,” Friedlander explains.

“The mental health situation in the country is very concerning and helpful interventions are crucial. For our clients, encouraging consistent engagement in the Vitality model is key in a consistent understanding of their mental wellbeing,” says Friedlander.

The power of our Shared-value Insurance model remains strong for clients.

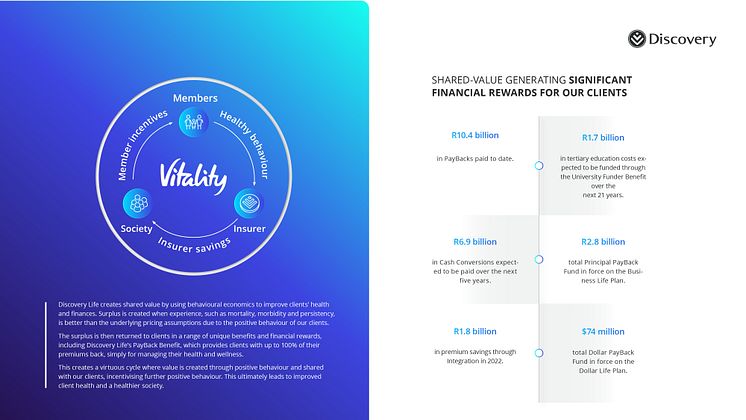

During 2022, Discovery Life paid out R1.3 billion in PayBacks and its clients enjoyed R1.8 billion in premium savings by linking other Discovery products to their Life Plan.

“These Shared-value benefits are expected to accelerate, as we expect to pay R6.9 billion in Cash Conversions within the next five years and R1.7 billion in tertiary education costs through the University Funder Benefit over the next 21 years,” Friedlander added.

“Discovery Life’s Shared-value Insurance model continues to reward clients in meaningful ways as they make healthier choices to better manage their underlying risk. In doing so, we remain true to our core purpose of making people healthier and enhancing and protecting their lives.”

Discovery Life 2022 claims experience demonstrates unwavering support to individuals and families during their most challenging life journeys.

Cumulatively, Discovery Life has paid out R47 billion in claims to clients since its inception in 2000 with an exemplary track record of paying 99% of claims. It has also paid out more than R10.4 billion in PayBacks to clients.

The significant levels of claim pay-outs and shared-value in the form of PayBacks and Cash Conversions for clients throughout 2022 reiterate the relevance of Discovery Life’s product suite. “We continue to demonstrate our core purpose which protects lives through comprehensive, holistic benefits, all while making people healthier and rewarding them for this, ultimately enhancing the quality of their lives. This gives clients both immense value and peace of mind, as few other things can,” he concludes.

Categories

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, banking, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in over 35 markets with over 20 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA