Press release -

Discovery Bank launches interactive rewards tool

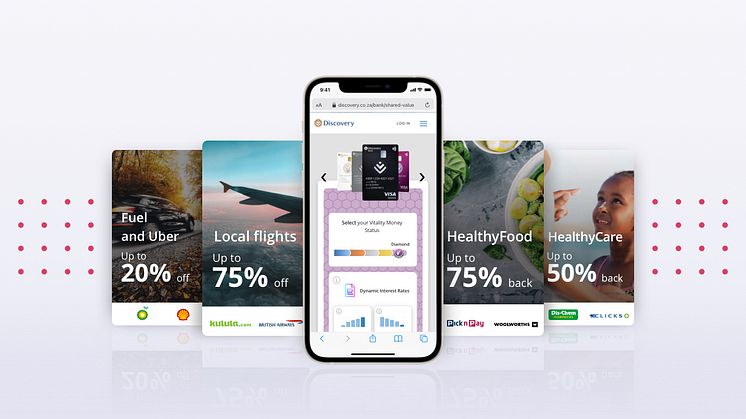

Johannesburg, 10 June 2021 - Discovery Bank offers a unique client experience as a shared-value bank. And, with its new interactive, online Shared-Value Stack which is now accessible on the Discovery website, it’s possible for everyone to see how financial products and individual financial behaviour interconnect to create much greater banking value for clients through improved interest rates, lifestyle savings, financial rewards and the available sophisticated banking features.

Hylton Kallner, CEO of Discovery Bank, said, “We’re operating in an entirely new category of banking – simply put, clients are not just offered banking benefits based on their household income. We’ve seen that financial choices have a far bigger impact on the actual risk that people pose to a bank than just their income alone. This was evidenced through research that showed that a significant percentage of high-income earners experience difficulties meeting financial obligations.

With our shared-value banking approach, each client is seen as an individual and their distinct financial behaviours play a role in how Discovery Bank determines their financial health and risk; based on this, they are rewarded from the start to change or maintain the behaviours correlated to managing money well. We not only guide people to adopt the behaviours that lead to greater financial security, but also acknowledge managing money well, regardless of income level.”

The shared-value rewards for managing money well, manifest through a stack of banking benefits based on a variety of factors, including financial choices linked to a Vitality Money status. There are various case studies that show how shared-value banking manifest in greater value for clients.

Kallner continued, “Our new interactive Shared-Value Stack is a visual representation of how clients can tailor their Discovery Bank account and the rewards they can derive from it. It allows people to select products, a specific Vitality Money status and certain other factors, to see exactly how every aspect of our fully digital banking products will manifest for the client. Based on the factors selected on the online banking Shared-Value Stack, people can see how Discovery Bank physically shares value back with them through some of the best interest rates in the market, discounts on essentials and through Discovery Miles; our currency providing more value than cash; which can be used in many different ways across a client’s banking portfolio to add to their spending power and general financial wellbeing. While bank rewards are often an opaque and complex world, the interactive Shared-Value Stack is designed to show clients exactly what they can earn from their Discovery Bank account – and compare accounts across the range.”

How the visual comparison of shared-value banking rewards works:

Once on the page, which can be accessed here:

1. Select the Discovery Bank product, which includes a suite account, credit card or transaction accounts.

2. Indicate other memberships of Vitality Health or Vitality Drive that apply.

3. Click on the Vitality Money status bars, Blue, Bronze, Silver, Gold or Diamond, below the different Discovery Bank cards.

Each status will indicate the related value created from products and financial behaviours that determine a client’s Vitality Money status. These status-related, shared-value rewards include better interest rates on savings and borrowings, dynamic discounts on Healthy Food, and Healthy Care, travel discounts and Discovery Miles that can accumulate based on spend and financial, health and driving behaviour. The page also offers a view of all the additional banking features available through the comprehensive Discovery Bank app and allows clients to compare different packages on a side-by-side basis.

“This interactive tool, illustrating the shared-value stack of rewards provides a new way for our clients and everyone else to engage with Discovery Bank. They’ll see how they can derive more value from engaging in Vitality Money and managing their money well.”

“The power of shared-value banking is illustrated for us in the fact that since 2019, Discovery Bank clients have saved over R13 million on interest from their borrowings. They have also benefited from over R15.5 million in savings rate boosts. The tools we offer people can help them identify financial behaviours to create more financial value, and they can see the exact value that Discovery Bank will share back with them,” said Kallner.

Topics

Categories

About Discovery Bank

Discovery Bank is part of Discovery Limited, a financial services organization that operates in the healthcare, life assurance, short-term insurance, savings and investment and wellness across 28 markets. Discovery Bank is fundamentally designed differently through its shared-value model. Clients create value as they manage their money well that Discovery Bank shares back with them through better interest rates, deep discounts and significant rewards. The overall outcome is that clients experience greater financial wellbeing, it reduces the risk of defaults for Discovery Bank making the business more sustainable, and it addresses large-scale challenges, such as increased savings, that benefit society at large. Behaviour change and rewards are enabled through Vitality Money, an AI-Powered programme on the Discovery Bank app that which gives clients an understanding of behaviours that influence their financial wellbeing and how to manage their money. The better clients do, the higher their Vitality Money status and the greater the value they receive

Follow us on Twitter @Discovery_SA