Press release -

47% of Discovery Insure drivers have hybrid working arrangements in place

Johannesburg, 9 April 2024 – Hard lockdowns may feel like a lifetime ago but working from home (WFH) isn’t going anywhere. This is according to Discovery Insure data released today, analysing the driving trends of Vitality Drive programme members, which reveals that 23% of its clients who began working from home during the Covid-19 pandemic are still not back in office full time. It confirms that despite some companies calling employees back to the office five days a week, a degree of workplace flexibility has become normalised following the pandemic.

“Flexible working is still one of the top motivators for job seekers, as more people seek better work-life balance. This trend is reflected in Discovery’s own data, which corroborates several other studies,” says Robert Attwell, Discovery Insure CEO.

Attwell adds that while some companies pushed for the return to the office in favour of face-to-face interactions, clearer boundaries between work and personal time, and increased collaboration opportunities, others have chosen to embrace a hybrid approach instead.

“We’ve found that traffic volumes have increased during the work week on certain days, but overall, volumes are not where they were in 2019. Discovery Insure’s data suggests that we can still expect to see hybrid workplace models for some time if the current rate of change remains the same,” adds Attwell. “The data shows that while many South Africans are making their way back to the office, most aren’t working in the building for the traditional 9-to-5, five days a week. I believe this is because many companies – including Discovery – understand the benefits of hybrid work.”

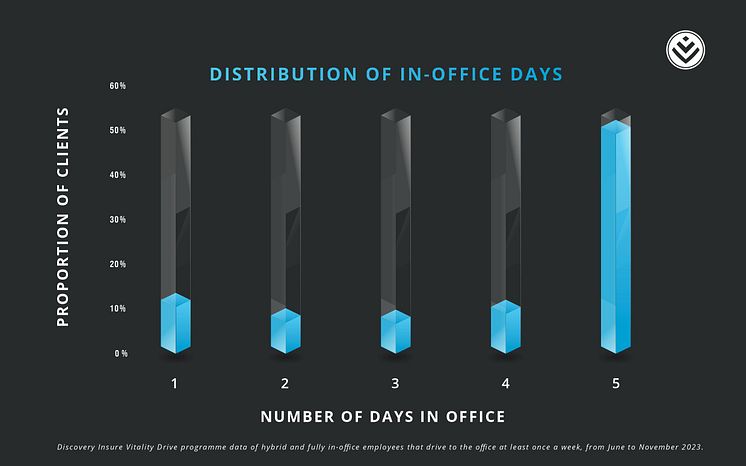

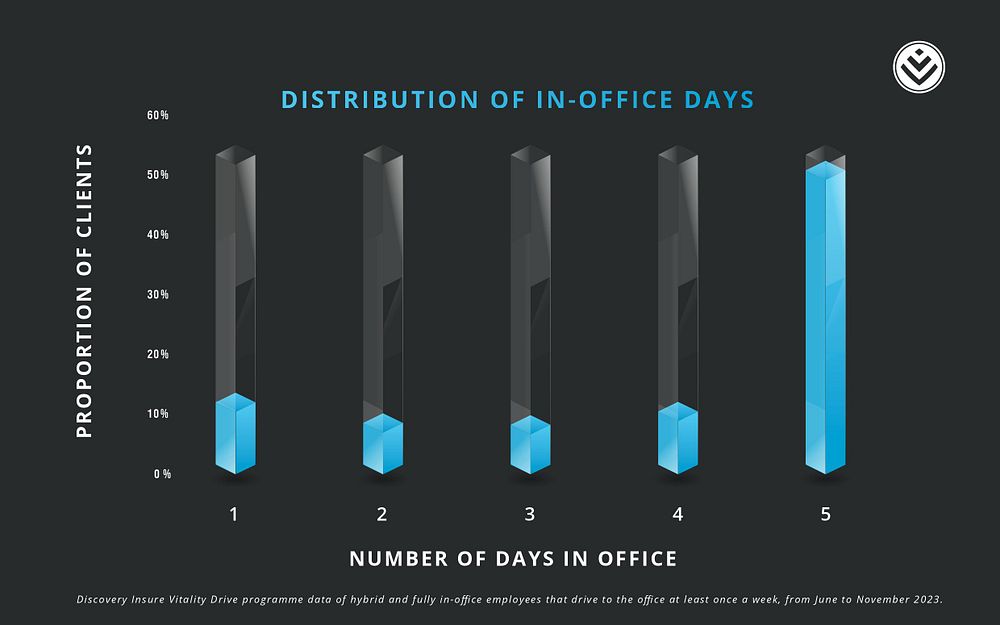

53% of people drive to the office five days a week; 14% only do so once a week

Discovery Insure’s analysis of driving patterns from June to November 2023 reveals that, of those who drove to the office, 53% did so five days a week. Overall, 75% of clients who work from offices are now commuting at least three times a week.

On the other hand, the data also shows that 14% of Vitality Drive members now go to the office only once a week. When they’re working from the office, South Africans spend the same hours there as they used to before the pandemic from Mondays to Thursdays, but they leave early on Fridays. “The data shows something that we already knew, too: South Africans like to knock off early at the end of the week, as they spend 20 minutes less in the office on Fridays,” adds Attwell.

Source: Discovery Insure Vitality Drive programme data of drivers that drive to the office at least once a week, from June to November 2023.

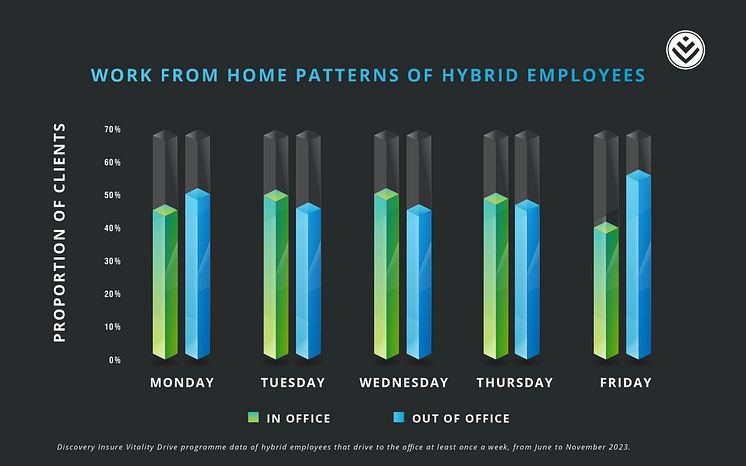

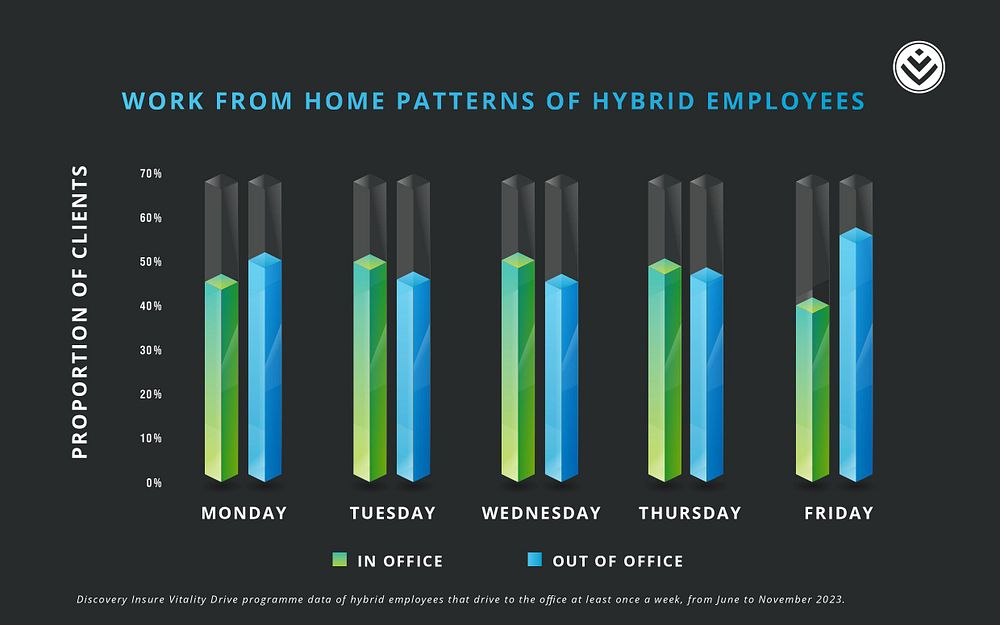

The data further revealed that offices are likely at their fullest on Wednesdays. That’s because nearly 80% of workers (full-time and hybrid) go into the office on Wednesdays. In contrast, Friday is the least popular day for working from the office.

“Data tells us that many Discovery Insure drivers follow a hybrid work model, which helps them avoid traffic – and the time and fuel wastage that comes with it. So, if you’re hybrid working a few days a week, and if you can choose which days you go into the office, make one of those in-office days a Friday, and if it’s a Wednesday, leave the house earlier to avoid traffic and congestion,” says Attwell.

Source: Discovery Insure Vitality Drive programme data of 104,519 hybrid employees that drive to the office at least once a week, from June to November 2023.

Interestingly, the data also shows that people who work from the office full-time generally drive the most on the weekends, too. This, says Attwell, could be because they don’t have as much time during the week to run errands, whereas people with hybrid work arrangements likely get time to do short grocery trips during their breaks or after work.

While globally some companies are challenging WFH models, with a preference for employees to be fully back in the office, it appears for the meantime that many South African companies are going – and staying – hybrid. Post-pandemic, employees want to retain flexible work arrangements, and as Discovery Insure’s data suggests, many employers have come on board, too.

“It remains to be seen whether South Africans will eventually return to 2019 full-time in-office levels,” says Attwell. “Since the global health pandemic, Discovery moved quickly to accommodate new ways of working, mindful of our values to protect people, and enhance and protect their lives,” says Attwell.

He adds that, so far, the numbers show that hybrid arrangements are beneficial to both employees and employers. “Insights from Discovery’s employee data show that in certain roles where the output is objectively measurable, workers in a hybrid model are more productive. When we take on a broader societal perspective, hybrid and WFH models have kept traffic volumes lower than pre-pandemic levels, which benefits all motorists.”

ENDS

Topics

Categories

Discovery information

About Discovery

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, banking, savings and investment and wellness markets. Since inception in 1992, Discovery has been guided by a clear core purpose – to make people healthier and to enhance and protect their lives. This has manifested in its globally recognised Vitality Shared-Value insurance model, active in over 40 markets with over 40 million members. The model is exported and scaled through the Global Vitality Network, an alliance of some of the largest insurers across key markets including AIA (Asia), Ping An (China), Generali (Europe), Sumitomo (Japan), John Hancock (US), Manulife (Canada) and Vitality Life & Health (UK, wholly owned). Discovery trades on the Johannesburg Securities Exchange as DSY.

Follow us on Twitter @Discovery_SA